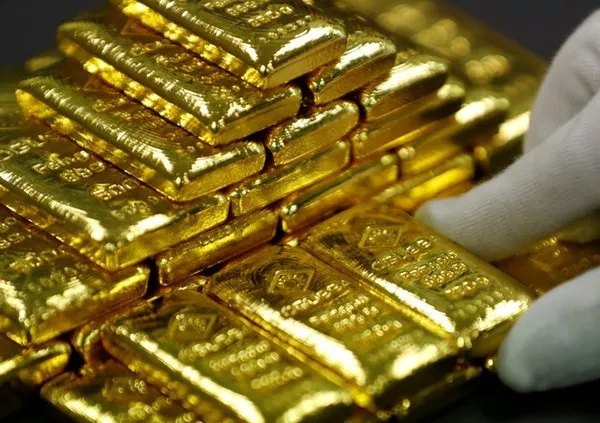

Gold’s impressive rally to successive record highs is poised to persist into the second half of 2024, supported by strong fundamentals, though reaching $3,000 per ounce may be slightly out of reach, according to traders and industry experts.

Investors have been flocking to gold, driven by expectations of monetary easing, geopolitical tensions in Europe and the Middle East, and significant central bank purchases, particularly from China. Spot gold is currently trading around $2,300 per ounce after hitting a record $2,449.89 on May 20, marking an 11% gain so far this year.

“There are many factors driving gold right now, but one of the major factors is China,” said Ruth Crowell, CEO of the London Bullion Market Association, at the Asia Pacific Precious Metals Conference in Singapore. “Usually, China and Japan have been budget shoppers, but given the state of the economy, real estate challenges, and equity markets, gold is a safe choice. I think gold is going to be of interest for some time.”

Central banks globally, particularly in China, have been increasing their gold reserves due to currency depreciation and geopolitical and economic risks. Gold is traditionally seen as a hedge against such risks and thrives in a low-interest-rate environment.

“Physical demand for gold is strong, but we have not seen retail investment demand coming in yet like exchange-traded funds,” said Amar Singh, Head of Metals for Asia Pacific and the Middle East at StoneX. “I see prices reaching $2,600 – $2,700 very easily this year.”

The timing of potential interest rate cuts from the Federal Reserve and the upcoming November U.S. elections are likely to introduce more market volatility, analysts noted. Despite the overall bullish sentiment, surpassing $3,000 per ounce appears unlikely at this point.

“It’s not a case of some particular factor holding back gold but rather that $3,000 would mean another 30% increase from here, which is quite a lot given we have already seen substantial gains,” said Nikos Kavalis, managing director at Metals Focus.