In the wake of last Friday’s stronger-than-expected US jobs report, the futures market has altered its predictions regarding interest rate cuts at the upcoming Federal Open Market Committee (FOMC) meeting scheduled for November 7. Traders have shifted their focus from anticipating a second 50 basis points (bps) cut to expecting a more modest reduction of 25 bps.

This week, Federal Reserve officials are likely to express optimism regarding the September nonfarm payrolls, which saw an increase to 223,000, up from 159,000 in August. Additionally, the unemployment rate has decreased from 4.2% to 4.1%. However, officials are expected to urge caution, advising against overreacting to a single month’s data, and will emphasize their commitment to gradually easing monetary policy restrictions.

Given our assessment that the Fed Funds Rate may decline by an additional 200 bps through 2025, we foresee limited upside potential for the US Dollar Index (DXY), projecting a peak around 103 before it resumes its downward trajectory.

You Might Be Interested In

- Bank of Canada Governor Warns AI Adoption May Intensify Inflationary Pressures

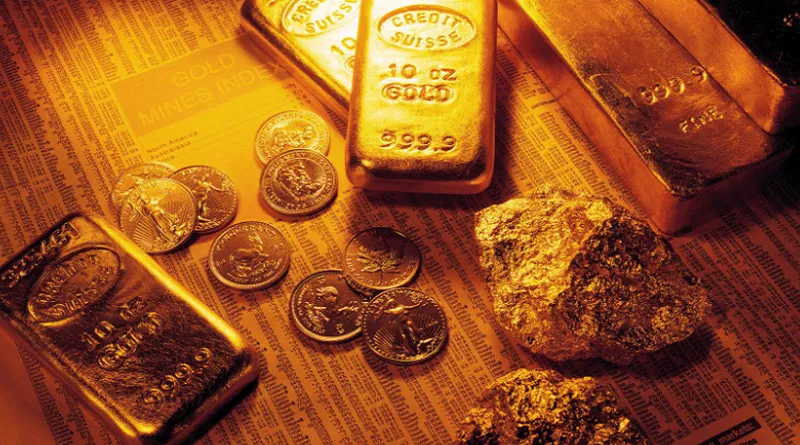

- Gold Prices Hold Steady Near Record Highs Despite Strong Labor Market Data

- Unemployment Claims Dip Below Expectations, US Dollar Remains Steady