Gold has long been considered a symbol of wealth and a reliable store of value. Historically, gold has provided a haven for investors seeking to protect their wealth from the risks and volatility inherent in global markets. But the question remains: when is the best time to buy gold? While the allure of gold remains strong, the answer is not straightforward, as it depends on a range of factors, including economic conditions, market trends, and individual investment goals.

This article delves into the key factors to consider when deciding to buy gold, examines different market conditions that affect gold prices, and offers insights into the best strategies for making gold investments.

Why Buy Gold? The Case for Gold in Your Portfolio

Before exploring when to buy gold, it’s important to understand why investors turn to this precious metal in the first place. Gold has several qualities that make it an attractive investment:

Hedge Against Inflation: Gold has historically been a good hedge against inflation. When inflation erodes the purchasing power of fiat currencies, the value of gold often rises, preserving wealth.

Safe-Haven Asset: During times of economic uncertainty, geopolitical tensions, or financial market volatility, gold serves as a safe-haven asset. Investors flock to gold when stock markets experience turbulence or when currencies face devaluation.

Portfolio Diversification: Gold can be an effective tool for diversifying an investment portfolio. Since gold often has a low or negative correlation with other asset classes, such as stocks and bonds, it can help reduce overall portfolio risk.

Tangible Asset: Unlike stocks, bonds, or cryptocurrencies, gold is a physical asset. Many investors find comfort in holding something tangible that has intrinsic value, which cannot be destroyed or digitally compromised.

Preservation of Wealth: For centuries, gold has been a reliable store of wealth. It maintains its value over long periods and is less affected by economic downturns or currency fluctuations compared to other assets.

Factors That Influence Gold Prices

To determine when to buy gold, it is crucial to understand the factors that influence its price. Gold prices are affected by a combination of global economic conditions, market sentiment, and macroeconomic factors. Here are the key influences:

a. Economic Uncertainty

Gold typically performs well during periods of economic uncertainty or recession. When the global economy slows down, investors tend to move away from riskier assets like stocks and into safe-haven investments like gold. Signs of economic instability include falling stock markets, rising unemployment, and declining consumer confidence.

b. Inflation and Interest Rates

Inflation, or the rise in the general price level of goods and services, erodes the purchasing power of currencies. When inflation rises, gold prices generally increase as investors seek protection against the declining value of paper currency. On the other hand, higher interest rates can make holding gold less attractive because gold does not generate income or interest, unlike bonds or savings accounts.

When central banks, such as the U.S. Federal Reserve, raise interest rates to combat inflation, gold prices can be negatively affected. Conversely, in a low-interest-rate environment, the opportunity cost of holding gold decreases, making it more attractive to investors.

c. U.S. Dollar Strength

Gold is often priced in U.S. dollars, and as a result, there is typically an inverse relationship between the strength of the dollar and gold prices. When the U.S. dollar weakens, gold becomes cheaper for investors holding other currencies, leading to higher demand and increased prices. Conversely, a strong U.S. dollar can dampen the demand for gold and cause its price to decline.

d. Geopolitical Tensions

Geopolitical events such as wars, political instability, and trade disputes can lead to an increase in gold prices. During periods of geopolitical tension, investors often turn to gold as a hedge against uncertainty. For example, conflicts in the Middle East, rising tensions between major economies like the U.S. and China, or political unrest in major gold-producing nations can significantly drive up the demand for gold.

e. Supply and Demand Dynamics

Gold is a finite resource, and its supply is largely influenced by mining production, recycling, and central bank sales or purchases. If the supply of gold decreases or becomes constrained due to geopolitical events, labor strikes in major mining regions, or declining production, gold prices may rise.

At the same time, demand for gold comes from various sources—jewelry, investment, central bank reserves, and industrial uses. A rise in demand from these sectors can drive up the price of gold.

When Is the Best Time to Buy Gold?

The decision of when to buy gold is influenced by several factors, including personal financial goals, market timing, and broader economic trends. Below are some scenarios in which buying gold may make sense.

a. During Economic Downturns

As mentioned earlier, gold tends to perform well during times of economic uncertainty. Investors often buy gold during recessions, stock market crashes, or periods of declining economic growth. If you anticipate an economic downturn or a period of increased market volatility, buying gold can help protect your portfolio.

For example, during the 2008 global financial crisis, gold prices surged as investors sought safe-haven assets amid the collapse of financial markets. Similarly, during the COVID-19 pandemic, gold prices reached all-time highs as the global economy faced unprecedented challenges.

b. When Inflation Is Rising

Gold can be an effective hedge against inflation. If inflation rates are rising, central banks may eventually raise interest rates, but in the short term, inflation typically pushes gold prices higher. Investors looking to preserve their wealth in an inflationary environment often turn to gold. If inflation is rising and economic indicators point to sustained inflation, it might be an opportune time to buy gold.

c. In Low-Interest-Rate Environments

When central banks lower interest rates, the opportunity cost of holding non-yielding assets like gold decreases. In such an environment, gold can become more attractive to investors. If interest rates remain low or central banks signal future rate cuts, consider adding gold to your portfolio.

d. As Part of a Long-Term Investment Strategy

Gold is not just a short-term hedge against economic crises—it can also be part of a long-term investment strategy. Investors with a long time horizon may want to allocate a portion of their portfolio to gold for diversification and wealth preservation.

Some financial advisors recommend holding 5-10% of a portfolio in gold or other precious metals as a form of insurance against market downturns, currency devaluation, or inflation.

Timing the Market: Is It Feasible?

Many investors wonder whether they can time the gold market, buying when prices are low and selling when prices are high. While timing the market sounds appealing, it is notoriously difficult to predict short-term price movements accurately.

Gold prices can be influenced by a wide range of factors, many of which are difficult to anticipate. For instance, geopolitical events and unexpected economic shifts can lead to sudden changes in gold prices. Therefore, rather than trying to time the market, many investors opt for a dollar-cost averaging strategy. This involves buying gold at regular intervals, regardless of the price, to smooth out price fluctuations over time.

5. Different Ways to Buy Gold

When considering a gold investment, it’s essential to understand the various ways to buy and hold gold:

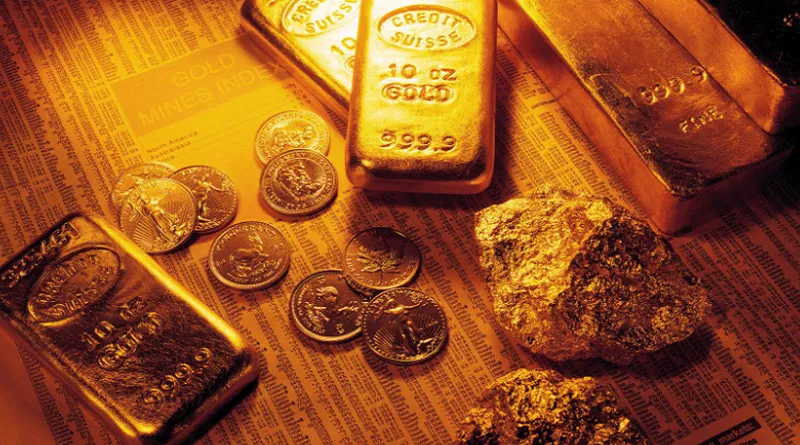

Physical Gold: This includes gold bars, coins, and bullion. Physical gold can be stored at home or in a secure vault, but it comes with risks such as storage costs and insurance.

Gold ETFs (Exchange-Traded Funds): ETFs are financial instruments that track the price of gold. They allow investors to gain exposure to gold without having to hold the physical asset.

Gold Stocks and Mutual Funds: Investing in gold mining companies or funds that hold shares in gold miners can provide exposure to gold while also offering the potential for dividends.

Gold Futures and Options: These financial contracts allow investors to speculate on the future price of gold but carry a higher degree of risk and are best suited for experienced investors.

See Also Why Are Gold Futures Higher Than Spot Prices?

Conclusion

There is no single answer to the question of when to buy gold. Instead, the decision should be based on an analysis of current economic conditions, personal investment goals, and market trends. Whether you are seeking to hedge against inflation, protect your portfolio during an economic downturn, or diversify your investments, understanding the factors that influence gold prices can help you make more informed decisions.

In uncertain times, gold has proven to be a valuable asset for preserving wealth and providing security. By keeping an eye on economic trends and market signals, and considering gold as part of a broader, diversified investment strategy, you can optimize the timing and impact of your gold purchases.

You Might Be Interested In

- What is a Major Disadvantage of the Gold Standard?

- Are Gold Bars Hard to Sell?

- What Investments Are Better Than Gold? An In-Depth Look