In today’s financial landscape, key market ratios and momentum trends are offering critical insights into risk sentiment across various asset classes. From U.S. bonds to gold, silver, and even Bitcoin, the signals are clear: investors are showing an increasing appetite for risk.

Risk Appetite and Market Sentiment

- SPY vs TLT – S&P 500 vs U.S. Bonds The relationship between the S&P 500 (SPY) and the safest debt instrument, U.S. Treasury Bonds (TLT), is an important indicator of risk sentiment. Historically, stocks offer higher returns than bonds but come with greater risk. Currently, the rising SPY/TLT ratio signals an increasing preference for risk, with investors favoring stocks over the safety of bonds—a clear sign of a “risk-on” environment.

- HYG vs TLT – High-Yield Corporate Debt vs U.S. Bonds A similar trend is emerging in the high-yield bond market, where the performance of the iShares iBoxx High Yield Corporate Bond ETF (HYG) is outpacing that of U.S. Treasury Bonds (TLT). This suggests that risk appetite is extending into fixed-income markets, with investors willing to take on more risk for higher yields.

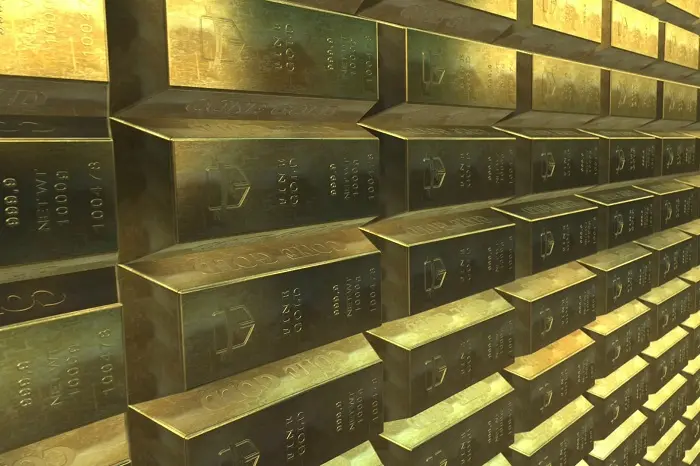

- SPY vs GLD – S&P 500 vs Gold The performance of the S&P 500 relative to gold (GLD) is another important gauge. When the S&P 500 is outperforming gold, it typically signals a preference for riskier assets, as investors move away from traditional safe havens like gold. Currently, SPY is outperforming GLD, reinforcing the “risk-on” sentiment in equities.

- WOOD vs GLD – Lumber vs Gold The ratio between lumber (WOOD) and gold (GLD) offers a unique perspective on economic conditions. A rising WOOD/GLD ratio suggests that the relative performance of lumber is improving compared to gold, which is often seen as a sign of an improving economy.

Gold, Silver, and Bitcoin Momentum

While both gold and silver are currently trading below their respective 50-day moving averages, recent momentum suggests a potential turn. However, gold is still underperforming the S&P 500 (SPY), and silver continues to lag behind gold, highlighting that risk appetite remains firmly skewed toward equities rather than precious metals.

Bitcoin and other digital assets, while not directly mentioned in the ratios above, are also part of the broader “risk-on” narrative. As traditional safe-haven assets like gold show signs of underperformance, riskier assets such as Bitcoin could benefit from this market shift.

Actionable Indicators and ETF Summary

For those looking to navigate this market, focusing on key support and resistance levels in major ETFs can provide clear, actionable insights. Below are pivotal levels to watch for various asset classes:

- S&P 500 (SPY): Support at 575, resistance at 600

- Russell 2000 (IWM): Support at 227, resistance to clear at 244

- Dow (DIA): Support at 430

- Nasdaq (QQQ): 500 is now pivotal

- Regional Banks (KRE): 65 is pivotal

- Semiconductors (SMH): 235 is the 200-DMA to hold, with resistance at 250

- Transportation (IYT): Looks solid if it holds above 71

- Biotechnology (IBB): Support at 132, resistance at 138

- Retail (XRT): 78.50 is a key pivotal support level

- iShares iBoxx High Yield Corporate Bond ETF (HYG): 79.50 is pivotal

As we assess the current market dynamics, it’s clear that investors are embracing risk. The upward trends in stock market indices, high-yield bonds, and the relative strength of sectors like semiconductors and transportation underscore a market with increasing risk appetite. However, caution remains necessary, as changes in these key ratios could signal shifts in sentiment. For now, the outlook remains “risk on.”

Related topics:

- Asia Gold Festivities Boost Demand in India, But Volumes Lag

- Gold Prices Drop Rs 2,500 Per Tola in Pakistan

- Gold Prices Decline from Record Highs in India on November 1