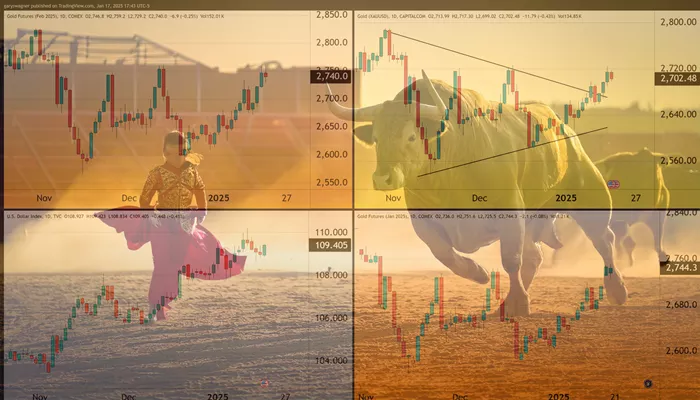

Gold futures experienced a split performance in today’s trading session, reflecting investors’ complex reactions to shifting monetary policy expectations and political uncertainty. The February gold futures contract settled lower at $2,740, a decrease of $7.10, or 0.76%. Despite this, it posted a notable weekly gain of $22.40. In contrast, spot gold saw a modest decline of $11.79 (0.43%), closing at $2,702.48, while still managing a small weekly advance of $13.04 per troy ounce.

This recent performance extends gold’s winning streak to three consecutive weeks, with a roughly 0.5% gain in the current period. The upward momentum was notably sparked by the release of softer-than-expected U.S. core inflation data on Wednesday, which fueled speculation over possible Federal Reserve monetary policy shifts.

Market sentiment has increasingly leaned toward the expectation of multiple rate cuts in the coming year. This view was further bolstered by comments from Federal Reserve Governor Christopher Waller, who suggested that the central bank could pursue more aggressive monetary easing should economic indicators continue to show weakness. Despite a 0.45% daily gain in the dollar index, which rose to 109.48, the greenback posted a weekly decline of 0.23%.

Today’s trading also featured a notable divergence between the January and February gold futures contracts. While the February contract fell, January futures rose by $5.20, or 0.19%, to $2,751.60. This shift reflects increased investor demand for safe-haven assets, driven by growing policy uncertainty. The unusual split in near-term futures prices suggests differing assessments of immediate and longer-term market risks.

Political transition uncertainties are also playing a significant role in shaping trading patterns. Trevor Yates, a strategic analyst at Global X, expressed cautious optimism in a note to clients, stating, “We remain positive on gold heading into the new year but continue to monitor any potential policy changes from the new U.S. administration.” Investors are particularly concerned about the potential impact of trade policies, including tariffs that could drive inflation and escalate trade tensions.

The current market dynamics indicate a careful balancing act between macroeconomic factors and policy uncertainties. Investors appear to be positioning themselves in gold as a hedge against potential volatility from both monetary policy changes and evolving trade relations. The divergence in futures contract pricing underscores how market participants are adjusting their risk exposure across different time frames, while maintaining a generally positive outlook on gold as a strategic asset.

As the market continues to focus on upcoming policy developments and their economic consequences, gold’s role as both a hedge against uncertainty and a proxy for inflation remains central to trading activity in both spot and futures markets.

Related topics:

- India Surpasses China in Gold Purchases, Buying 51% More in Three Months

- Gold Rates Skyrocket in Chennai on Diwali, 24K Gold Exceeds Rs. 81,000 Per 10 Grams

- Gold and Silver Prices Rise Across India on January 13, 2025