In the world of investing and stock trading, there are many different terms and strategies that traders use to predict market trends. One of the most commonly discussed patterns is the golden cross. This pattern is widely used by traders as a signal for potential price movements in the market. But what exactly is a golden cross, and why is it important for traders? In this article, we will break down the concept of the golden cross in simple terms and explain how it can be used to make better trading decisions.

What is a Golden Cross?

A golden cross is a technical analysis pattern that occurs when a short-term moving average crosses above a long-term moving average on a stock chart. This pattern is often seen as a sign of a potential upward trend in the price of a stock or asset. The most common moving averages used to identify this pattern are the 50-day moving average (short-term) and the 200-day moving average (long-term).

The Moving Averages: Key to the Golden Cross

To understand the golden cross fully, it’s important to first understand what a moving average is. A moving average is a tool used by traders to smooth out price data over a specific period. It helps to eliminate day-to-day price fluctuations and gives a clearer picture of the stock’s overall trend.

There are different types of moving averages, but the two most common are:

Simple Moving Average (SMA): This is the average of a stock’s price over a specific period of time, such as 50 or 200 days. It is calculated by adding up the closing prices of the stock for a set period and dividing by the number of days.

Exponential Moving Average (EMA): This type of moving average gives more weight to recent prices, making it more responsive to price changes. While the SMA is the most commonly used in the golden cross, some traders may prefer the EMA for its faster reaction to market movements.

The 50-Day Moving Average (50-MA) and the 200-Day Moving Average (200-MA)

The 50-day moving average (50-MA) is a short-term indicator. It is calculated by averaging the closing prices of the past 50 days. This average is used to identify short-term trends in the market, and it reacts quickly to recent price changes.

The 200-day moving average (200-MA) is a long-term indicator. It is calculated by averaging the closing prices of the past 200 days. This moving average shows the overall direction of the stock or market and is much slower to react to recent price changes compared to the 50-MA.

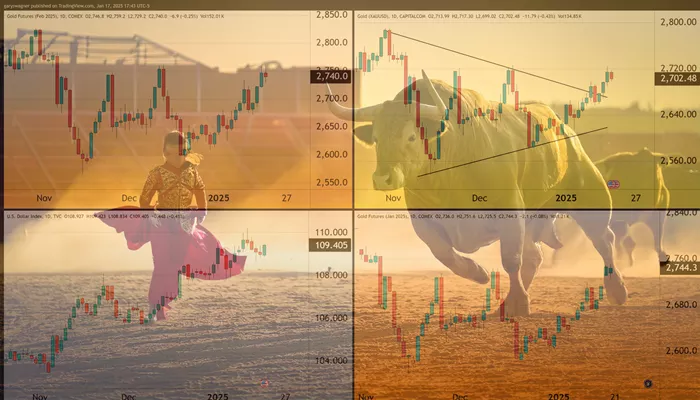

When the 50-MA crosses above the 200-MA, it forms the golden cross pattern. This is seen as a signal that the stock’s price may continue to rise. The golden cross is often followed by a bullish market trend, which means investors may expect the price of the stock to increase.

Why Is the Golden Cross Important?

The golden cross is an important signal for both traders and investors because it suggests a shift in market sentiment. The crossing of the short-term moving average above the long-term moving average indicates that recent prices are higher than older prices, which suggests growing optimism in the market.

A Sign of Bullish Market Sentiment

A golden cross is generally interpreted as a bullish signal, meaning that the stock or market may experience an upward trend. It suggests that the stock’s price is gaining momentum and could continue to rise in the near future. Traders often look for this pattern as a signal to buy, hoping to profit from the expected rise in price.

The golden cross also indicates that more buyers are entering the market and driving the price upward. This could be the result of strong earnings reports, positive news, or other factors that make investors feel more confident in the stock.

Confirmation of the Trend

While the golden cross is seen as a positive signal, it’s important to remember that no indicator is 100% accurate. Traders typically look for additional signs to confirm the golden cross before making decisions. For example, volume is an important factor in confirming the strength of a trend. A golden cross that is accompanied by an increase in trading volume is often seen as a more reliable signal.

Market Timing: The Golden Cross as a Tool for Decision-Making

Traders use the golden cross to help time their entries and exits from the market. The pattern is often used by both short-term and long-term traders to make buy decisions. For long-term investors, the golden cross may be seen as a signal to hold onto their investments, while short-term traders may look for opportunities to buy in anticipation of a short-term price rise.

It’s important to remember that the golden cross doesn’t guarantee profits, but it provides traders with valuable information to help make better decisions. The golden cross is one of many tools that traders use to understand market trends and identify potential opportunities.

The Reverse: Death Cross

The opposite of the golden cross is the death cross. This occurs when the short-term moving average (50-MA) crosses below the long-term moving average (200-MA). While the golden cross is considered a bullish signal, the death cross is seen as a bearish signal, indicating that the stock’s price may fall.

While the golden cross suggests a potential for upward movement, the death cross suggests a possible decline. Traders often look for the death cross as a signal to sell or avoid buying certain stocks.

How to Spot a Golden Cross on a Chart

Spotting a golden cross on a stock chart is relatively easy once you understand how moving averages work. Here’s how to identify the pattern:

Look for the 50-day moving average (50-MA): This will be the faster-moving average that responds quickly to recent price changes.

Look for the 200-day moving average (200-MA): This will be the slower-moving average that tracks the longer-term trend.

Watch for the crossover: The golden cross occurs when the 50-MA crosses above the 200-MA. This crossover can be identified by looking for the point where the two lines intersect.

Volume confirmation: Check if there is an increase in trading volume around the time of the crossover. Higher volume can indicate that the trend is strong and may continue.

How Traders Use the Golden Cross

Traders and investors use the golden cross in a variety of ways. Some use it as part of a larger trading strategy, while others may rely on it as a standalone signal. Here’s how traders may use the golden cross:

Buy Signal for Short-Term Traders

Short-term traders, also known as day traders or swing traders, often use the golden cross as a signal to buy stocks in anticipation of a price rise. They may look for confirmation from other indicators, such as trading volume, to ensure that the trend is strong. If the golden cross occurs along with other bullish signals, such as a breakout or strong earnings reports, traders may feel more confident in their decision to buy.

Hold Signal for Long-Term Investors

For long-term investors, the golden cross can be a signal to hold onto stocks that are already part of their portfolio. The crossover of the moving averages suggests that the stock is likely to continue rising, so investors may choose to stay invested for the long haul. However, they will also keep an eye on other factors that may influence the stock’s price, such as market conditions and company performance.

Confirmation of a Trend

Traders often use the golden cross to confirm the direction of an existing trend. If a stock has already been moving upward but hasn’t yet formed a golden cross, the pattern can serve as confirmation that the trend is likely to continue. This can give traders more confidence in their decisions to buy.

Part of a Larger Trading Strategy

Many traders incorporate the golden cross into a larger strategy that includes other indicators. For example, traders may use the golden cross along with the Relative Strength Index (RSI) or Bollinger Bands to get a better sense of whether the stock is overbought or oversold. The golden cross can be one piece of the puzzle, helping traders make more informed decisions.

Limitations of the Golden Cross

While the golden cross is a powerful tool, it is not foolproof. There are several limitations to consider:

False Signals: Not every golden cross results in a sustained upward trend. In some cases, the price may rise briefly before reversing direction. This is known as a “false signal.”

Lagging Indicator: Moving averages are lagging indicators, meaning they are based on past price data. As a result, the golden cross may occur after the price has already started to rise, making it less useful for predicting immediate price changes.

Market Conditions: The effectiveness of the golden cross can vary depending on market conditions. In a highly volatile market, the golden cross may not be as reliable as it would be in a stable market.

Conclusion

The golden cross is an important concept in stock trading that can help traders and investors identify potential buying opportunities. By understanding the pattern and using it in combination with other technical indicators, traders can make more informed decisions and increase their chances of success in the market. However, like all trading signals, the golden cross is not foolproof, and it is important to consider other factors when making investment decisions. Whether you are a short-term trader or a long-term investor, the golden cross is a valuable tool in your trading toolkit.

Related topics:

- Knowing the Weight of Gold: How Many Grams in a Troy Ounce?

- Why Are Gold Coins Different Prices?

- Gold Prices Steady Ahead of US Fed Decision; Experts Share MCX Strategy