Global equity markets rose, led by solid gains in US equities, as markets cheered the passage of a debt ceiling bill that averted a catastrophic US default. Debt negotiations in Washington have been a key focus for markets in recent weeks, and the passage of the legislation that lifts the government’s $31.4 trillion debt ceiling removes a major uncertainty.

The S&P 500 rose 1.8%, while the Nasdaq 100 index surged 1.7%. The German DAX 40 advanced by 0.4% while the UK FTSE 100 slipped by 0.2%. In Asia, the Hang Seng index advanced 1.1%, while Japan’s Nikkei 225 rose 2.1%.

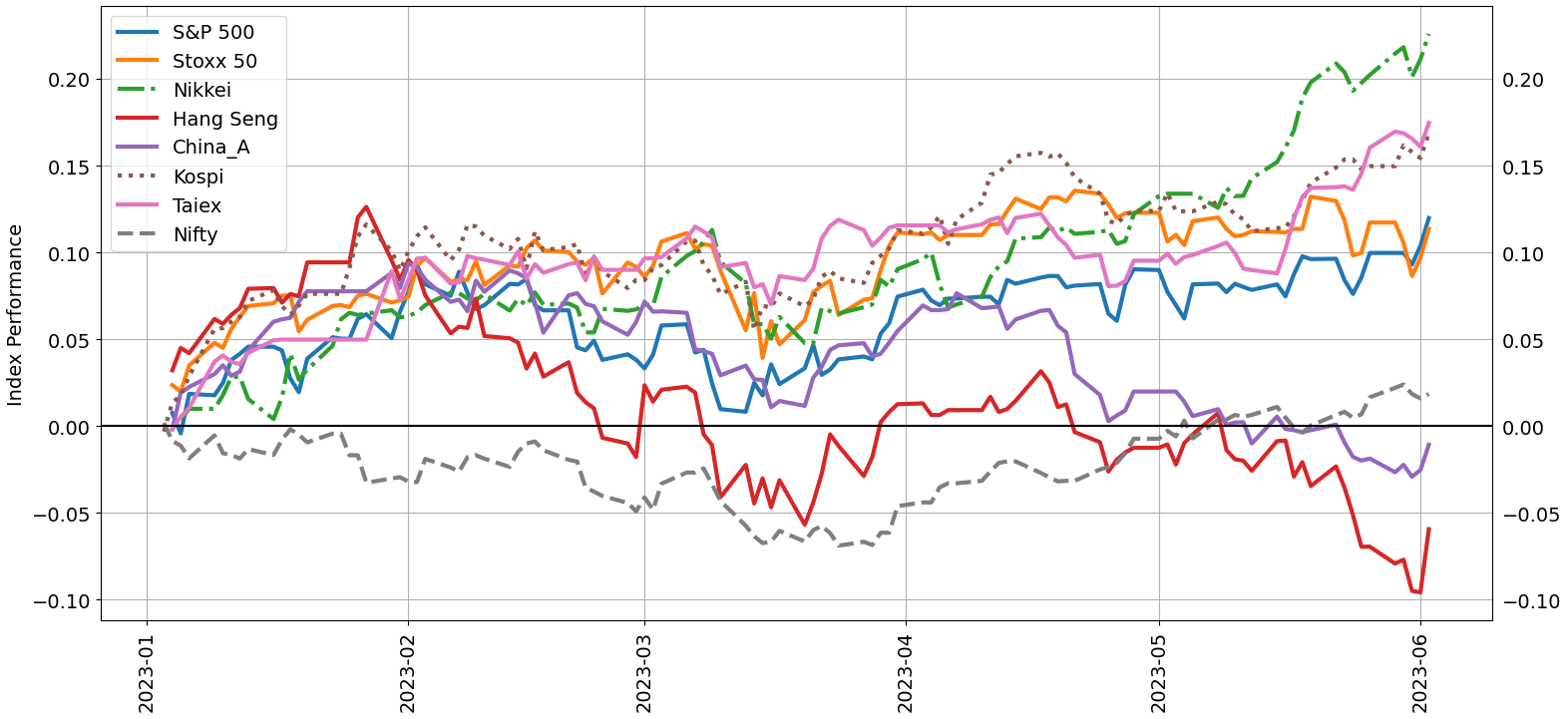

Past week market performance

In addition, US data have been better than expected in recent weeks, according to the Economic Surprise Index. On Friday, nonfarm payrolls grew much more than expected in May, suggesting tighter labour market conditions. However, with the US Federal Reserve expected to pause hiking rates, inflation moderating in recent months, and economic growth showing signs of resilience, equities appear to be in a sweet spot.

The market is now pricing in a 74% chance of a pause at the June 13-14 FOMC meeting, compared to 35% a week ago, after several Fed officials including the vice chair-designate pointed toward a ‘skip’ in June. “Skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming,” vice chair nominee Philip Jefferson said earlier in the week. However, any decision to hold rates steady should not be viewed as the end of the tightening cycle, he added. Fed Chair Powell earlier in the month left the door open for a pause at the June meeting.

In the coming week, US ISM Services PMI for May, along with China Caixin Services PMI for May on Monday. RBA interest rate decision and Euro area retail sales are due on Tuesday. RBA Governor Lowe’s speech and Australia’s Q1 GDP are due Wednesday. Japan Q1 GDP and Eco Watchers Survey, and Euro area Q1 GDP on Thursday. China May inflation data is due on Friday.

Forecasts:

Euro Weekly Forecast: EUR/USD Ends Week with a Whimper but a Recovery Remains in Play

A rather disappointing week on the whole as EURUSD in particular struggles for direction while the Euro lost further ground to both the GBP and JPY. Given the lack of catalysts ahead, is there any reason to expect the Euro to arrest its slump?

British Pound Week Ahead: GBP/USD, EUR/GBP and GBP/JPY Outlooks

The British Pound has enjoyed a strong week against a range of currencies, propped up by expectations that UK interest rates are going to have to go even higher.

Australian Dollar Outlook: The RBA Might Surprise Doves

The Australian Dollar recovered from a fresh low last week with the US Dollar ricocheting on the debt ceiling resolution, but the RBA could play a bigger role in the week ahead.

US Dollar Weekly Forecast: DXY Turns to Wall Street as Economic Docket Quiets Ahead

The US Dollar took a breather last week, with a still-tight labor market leaving the door open for the Fed to resume tightening in July. A lack of key economic data ahead places DXY’s focus on Wall Street.

Gold Price Forecast: Dreams of Fresh Record Shattered for Now as Bears Pounce

The outlook for gold is starting to become more bearish from a fundamental standpoint, as the resilience of the U.S. economy could induce the Federal Reserve to continue raising rates later this year.

S&P 500, Nasdaq Week Ahead: US Stocks Surge Despite Jobs Data Beat

US stocks head into the weekend buoyed by a more dovish Fed, a debt ceiling deal, and stable average hourly earnings. However, signs of overheating emerge