Investing in precious metals, particularly gold, has long been a reliable strategy for diversifying investment portfolios and preserving wealth. Among the various ways to invest in gold, purchasing spot gold stands out as a popular choice due to its direct ownership and potential for immediate delivery. In this comprehensive guide, we will walk you through the process of buying spot gold, providing valuable insights and tips to help you make informed decisions.

I. Understanding Spot

Gold Spot gold refers to physical gold purchased at the current market price. Unlike futures contracts or exchange-traded funds (ETFs), which involve financial derivatives, spot gold transactions are settled immediately, typically within two days. This form of investment offers tangible ownership of gold and allows investors to secure their assets outside of traditional financial systems.

II. Researching the Market

Before diving into buying spot gold, thorough research is essential. Consider the following factors:

Current Market Conditions: Stay updated on gold prices, global economic trends, and geopolitical events that can affect gold’s value.

Genuine Sellers: Identify reputable dealers and brokers who specialize in selling physical gold. Look for certifications and customer reviews to ensure credibility and reliability.

Storage and Insurance: Determine how you plan to store your gold securely. Evaluate insurance options to protect your investment from loss or damage.

III. Setting Your Budget

Decide on the amount you wish to invest in spot gold. It is recommended to allocate a certain percentage of your overall investment portfolio rather than putting all your eggs in one basket. Remember that gold prices fluctuate, so consider your risk tolerance and long-term investment goals.

IV. Choosing the Form of Spot

Gold Spot gold is available in various forms, each with its own advantages and considerations:

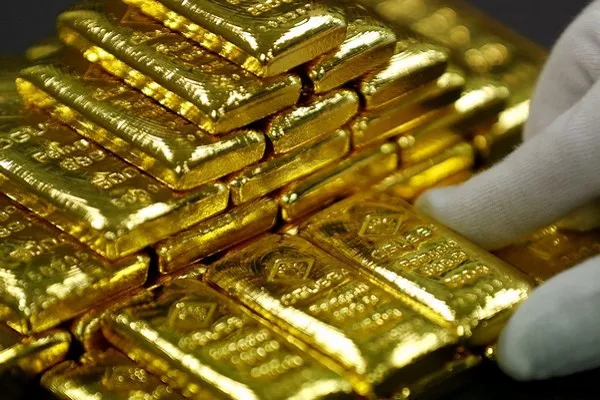

Bullion Bars:

These bars come in different weights and sizes, ranging from a few grams to several kilograms. Choose a reputable brand and ensure the bars have proper certification.

Gold Coins:

Popular coins include the American Eagle, Canadian Maple Leaf, and South African Krugerrand. Research the premiums and historical significance associated with different coin types.

Gold Rounds:

Similar to coins, gold rounds are privately minted but do not carry legal tender status. They often have lower premiums compared to coins.

V. Selecting the Seller

When buying spot gold, it is crucial to find trustworthy sellers who offer fair prices and reliable services. Consider the following:

Reputation and Experience: Choose established dealers or brokers with a solid track record in the precious metals market.

Transparency: Ensure the dealer provides clear pricing information, including premiums, fees, and shipping costs.

Verification: Verify the authenticity of the gold products by checking for appropriate hallmarks, serial numbers, and relevant certifications.

VI. Making the Purchase

Once you have chosen the seller and the form of spot gold, follow these steps to complete the purchase:

Lock-in the Price:

Confirm the current spot gold price with the seller and fix the price at the time of purchase to avoid any unexpected price fluctuations.

Payment Options:

Determine the acceptable payment methods, such as bank transfers, credit cards, or cashier’s checks. Be cautious of sellers insisting on cash payments.

Delivery and Insurance:

Arrange secure delivery or storage options. Insure the shipment to safeguard against loss or damage during transit.

VII. Storing and Insuring Your Spot Gold

To protect your investment, consider these important aspects:

Storage:

Choose a secure location like a reputable vaulting facility, safe deposit box, or home safe. Evaluate factors such as accessibility, insurance coverage, and peace of mind.

Insurance:

Obtain adequate insurance coverage for your gold to mitigate risks associated with theft, natural disasters, or accidents. Research insurance providers specializing in precious metals coverage.

Conclusion:

Investing in spot gold can be a rewarding venture, offering stability and value preservation during uncertain economic times. By understanding the nuances of buying spot gold, conducting thorough research, and partnering with reputable sellers, investors can confidently add this precious metal to their investment portfolios. Remember to stay informed, evaluate market conditions diligently, and seek professional advice if needed. With careful planning and due diligence, spot gold can serve as a secure and tangible asset for long-term financial security.