In a climate of cautious anticipation, gold prices remained relatively stable on Tuesday, with investors eagerly awaiting the release of U.S. inflation figures. These data points are poised to offer valuable insights into the future of interest rates, following the widely expected pause by the Federal Reserve scheduled for next week.

Fundamentals

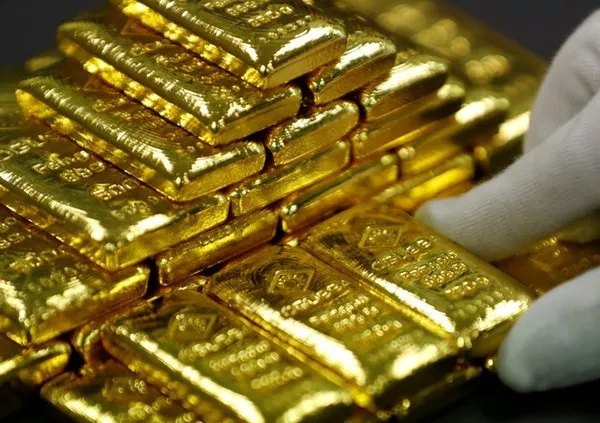

At 0042 GMT, the spot gold market held firm at $1,921.04 per ounce, while U.S. gold futures experienced a marginal dip of 0.1%, resting at $1,944.50.

The U.S. dollar index, having recorded its most significant intraday loss in two weeks during the preceding session, found stability in anticipation of the forthcoming U.S. Consumer Price Index (CPI) data, slated for release on Wednesday.

On the domestic front, the New York Fed reported that Americans’ overall perceptions of inflation remained relatively unchanged in August. Simultaneously, expectations for rising price hikes in various sectors, such as rent, housing, and food, were predicted, along with a less optimistic outlook concerning their personal financial circumstances.

U.S. Deputy Treasury Secretary Wally Adeyemo addressed concerns surrounding China’s economic situation, asserting that any resultant economic issues were more likely to affect the region than the United States. This statement came just a day after President Joe Biden characterized China’s economic condition as a “crisis.”

Meanwhile, the European Commission released a forecast indicating that the euro zone’s economic growth would be slower than initially anticipated for both the current year and the following year. This revised projection attributes the deceleration to consumer demand being hampered by high inflation and Germany, the largest economy in the Eurozone, teetering on the brink of recession this year.

In the United Kingdom, Bank of England policymaker Catherine Mann emphasized that it was premature for the BoE to halt its ongoing interest rate hikes.

Notable Developments

The world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, reported a 0.20% decline in its holdings on Monday, reducing the total from 886.64 tonnes on Friday to 884.89 tonnes.

In other precious metals markets, spot silver exhibited stability at $23.06 per ounce, platinum registered a minor decline of 0.2%, resting at $896.69, and palladium experienced a slight 0.2% drop, settling at $1,215.70.