Gold prices experienced a decline on Wednesday following a recent surge to two-week highs, as market participants eagerly awaited the U.S. Federal Reserve’s policy decision, hoping for insights into the economic outlook and the path of monetary tightening.

Key Developments:

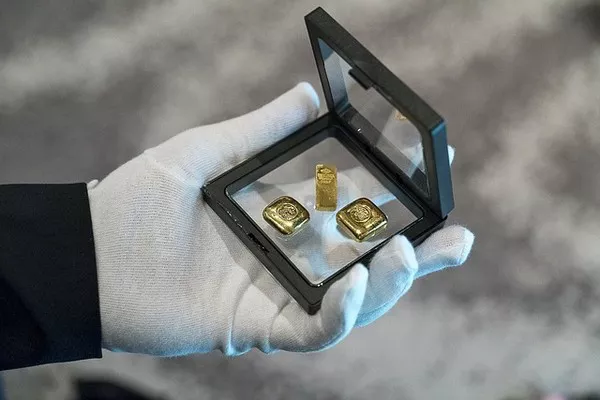

Spot gold edged down by 0.1% to $1,928.79 per ounce as of 0111 GMT, retracing from its highest point since September 5th, which it reached on Tuesday. Meanwhile, U.S. gold futures dipped by 0.2%, settling at $1,950.

Amid uncertainty surrounding the Fed‘s decision, some investors are seizing the opportunity presented by the fluctuations in Treasuries, believing that a peak in interest rates will ultimately bolster the U.S. government debt market.

Treasury Secretary Janet Yellen emphasized the need for U.S. economic growth to moderate to a pace more in line with its potential rate in order to bring inflation back to target levels, particularly since the economy was operating at full employment.

U.S. homebuilding faced a significant decline in August, sinking to a level not seen in over three years.

The Asian Development Bank (ADB) revised its expectations for economic growth in developing Asia slightly downward due to concerns related to the China’s property sector and El Niño-related risks.

The SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, reported a 0.2% reduction in its holdings on Tuesday.

Swiss gold exports increased by 7.3% in August compared to July figures, primarily due to higher deliveries to India and China, offsetting lower supplies to Turkey, as indicated by customs data.

Chinova Resources, a subsidiary of Shanxi Donghui Energy Group, has initiated the sale of its Australian copper-gold operations and aims to finalize the deal within this year, according to a director at adviser BurnVoir Corporate Finance, which is overseeing the sale.

In the broader precious metals market, spot silver saw a decrease of 0.4% to $23.14 per ounce, platinum dipped by 0.4% to $935.45, and palladium registered a marginal 0.1% increase to reach $1,260.86.

Upcoming Events (GMT):

U.S. Federal Open Market Committee (FOMC) will announce its interest rate decision followed by a statement at 1800 GMT.

The U.S. Fed chairperson is scheduled to hold a news conference at 1830 GMT.