In a recent interview on CNBC’s “Squawk Box,” billionaire investor Paul Tudor Jones expressed serious concerns about the possibility of an impending recession in the first quarter of the coming year. His prediction is rooted in what he perceives as hawkish policies emanating from the Federal Reserve and the concurrent surge in yields on long-term U.S. Treasury bonds.

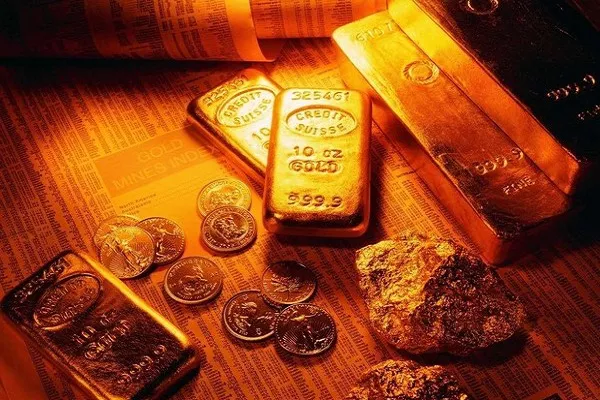

Paul Tudor Jones, renowned as the founder of Tudor Investment Corporation, is convinced that as uncertainty looms, investors will gravitate towards assets like gold and Bitcoin. Jones envisions that gold may see an inflow of $40 billion, while Bitcoin is poised to garner greater interest from risk-averse investors, especially amid the backdrop of a challenging U.S. political climate and escalating global geopolitical tensions. At the time of his interview, Bitcoin was trading at $27,444, reflecting a modest 0.3% increase in value over the preceding 24 hours.

The seasoned investor pointed to several warning signs of an imminent recession, including a steep yield curve, the potential for a 12% stock market decline, and the prospect of further interest rate hikes that could eventually tip the economy into recession. He further proposed that both gold and Bitcoin would hold a more prominent place in investment portfolios as economic uncertainties continue to mount.

Jones reaffirmed his enduring interest in Bitcoin and gold, a stance initially driven by concerns about inflation, geopolitical instability, and impending interest rate hikes. He first entered the Bitcoin market when it was gaining recognition as an inflationary hedge, a move that sparked a notable surge in the cryptocurrency’s value and drew in numerous investors. While inflation concerns have receded and regulatory scrutiny on Bitcoin has intensified, Jones has somewhat adjusted his position but continues to maintain a limited Bitcoin holding.

In addition to his thoughts on Bitcoin and gold, Paul Tudor Jones underlined the challenging landscape for U.S. equity investors. He shed light on two significant obstacles confronting the financial markets: the burgeoning U.S. debt-to-GDP ratio and the escalating interest rates. To address these concerns, Jones advocated for fiscal restraint as a necessary measure to mitigate the risks posed by these economic challenges.