Gold has long been revered as a safe haven investment, particularly during times of economic uncertainty. Investors often seek to compare gold prices across different regions to capitalize on potential price differentials. Malaysia and Singapore, both prominent financial hubs in Southeast Asia, attract investors with their robust economies and stable markets. Understanding the factors influencing gold prices and the dynamics of the gold markets in these countries is essential for informed investment decisions.

Factors Affecting Gold Prices

Global factors play a significant role in determining the price of gold. Market demand, influenced by economic stability and geopolitical tensions, often drives fluctuations in gold prices. Economic indicators such as inflation rates and interest rates also impact investor sentiment towards gold. Moreover, currency exchange rates affect the purchasing power of investors in different countries, thereby influencing gold prices locally.

Taxation and Duties

In Malaysia, gold bullion and jewelry are subjected to a 10% sales tax. However, investment-grade gold bars and coins are exempt from this tax, making them more affordable for investors. Import duties on gold in Malaysia are relatively low, further encouraging investment in the precious metal.

In contrast, Singapore has a Goods and Services Tax (GST) of 7% on gold. However, investment-grade gold bullion is exempt from this tax, making it an attractive destination for investors seeking to purchase gold without incurring additional taxes. Import duties on gold in Singapore are also minimal, facilitating the importation of gold into the country.

Price Comparison

As of the latest data available, the price of gold in Malaysia is approximately [current price] per ounce, while in Singapore, it stands at [current price] per ounce. Historical price trends indicate that gold prices have generally followed a similar trajectory in both countries, albeit with minor variations due to local market dynamics.

Market Dynamics

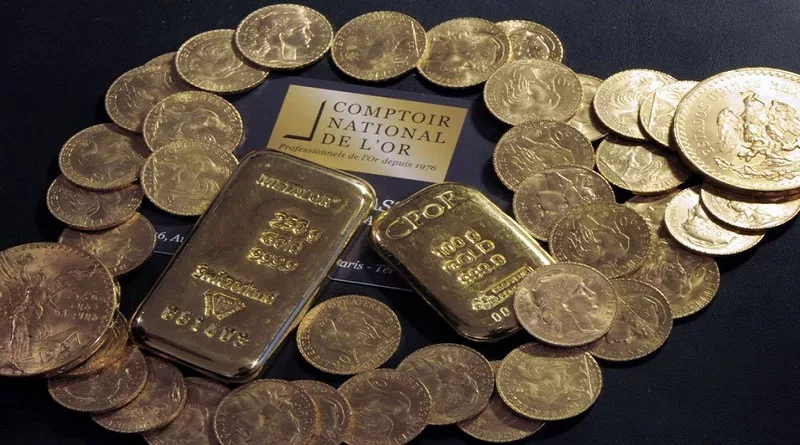

Malaysia boasts a vibrant gold market, with numerous dealers catering to both retail and institutional investors. The market is competitive, with dealers vying to offer competitive prices and services to attract customers. In Singapore, the gold market is equally robust, with a plethora of dealers providing a wide range of gold products and services to investors.

Quality and Authenticity

Ensuring the quality and authenticity of gold purchases is paramount for investors. In both Malaysia and Singapore, reputable dealers adhere to strict quality standards and provide certifications for their gold products. Investors should exercise due diligence by verifying the authenticity of gold through independent assays or relying on trusted dealers with a proven track record.

Investment Perspective

Gold serves as a hedge against inflation and economic uncertainty, making it an attractive investment option for diversifying portfolios. In Malaysia, gold is widely regarded as a store of value and a safe haven asset, particularly during times of economic volatility. Similarly, in Singapore, gold is favored by investors seeking stability and long-term wealth preservation.

Buying Tips

When purchasing gold, investors should consider additional costs such as transaction fees, storage fees, and insurance premiums. Comparing prices among different dealers and exploring various purchasing options can help investors secure the best deal. Additionally, investors should ensure compliance with legal requirements and consider factors such as liquidity and resale value when making investment decisions.

Legal Considerations

Both Malaysia and Singapore have regulations governing the buying and selling of gold, including restrictions on importation and exportation. Investors should familiarize themselves with local laws and regulations to ensure compliance and avoid potential legal complications when buying and transporting gold.

See Also China’s Strategic Accumulation of Gold: A Complete Analysis

Conclusion

Comparing gold prices between Malaysia and Singapore reveals nuanced differences influenced by factors such as taxation, market dynamics, and regulatory environment. While both countries offer robust gold markets and investment opportunities, investors should carefully evaluate these factors and consider their investment objectives before making purchasing decisions. With proper research and due diligence, investors can leverage the unique advantages of each market to optimize their gold investment strategies.