Investing in gold has long been a popular strategy for preserving wealth and hedging against economic uncertainty. Among the various ways to invest in gold, Gold Exchange-Traded Funds (ETFs) have emerged as a convenient and cost-effective option. This article delves into the world of Gold ETFs, providing a comprehensive guide on their definition, working mechanism, benefits, risks, taxation, comparison with other gold investment options, how to invest, performance analysis, role in portfolio diversification, and future outlook.

Definition of Gold ETFs

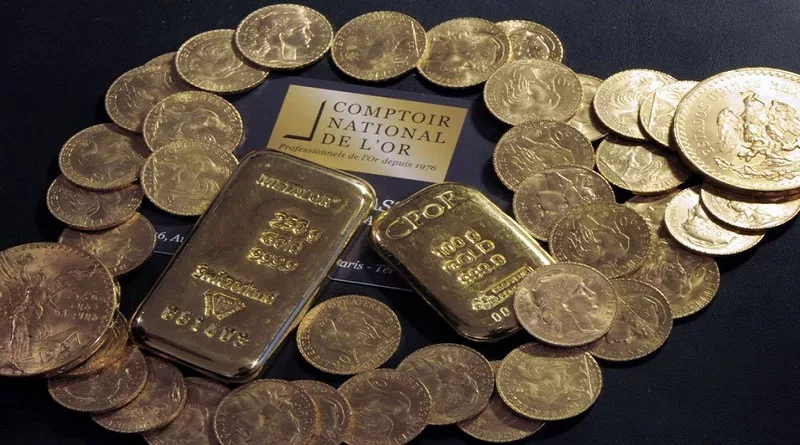

What are Gold ETFs? Gold ETFs are investment funds traded on stock exchanges, much like stocks. They are designed to track the price of gold, offering investors exposure to the gold market without the need to physically own the metal. A Gold ETF holds gold derivative contracts backed by gold bullion.

Difference from Physical Gold and Other Gold Investments Unlike physical gold, Gold ETFs do not involve storage or security issues. They are traded like regular stocks, providing liquidity and ease of access. Other gold-related investments include gold mutual funds, which invest in a portfolio of gold-related assets, and stocks of gold mining companies, which reflect the company’s performance rather than directly tracking gold prices.

Working Mechanism

Creation of Shares Gold ETFs work through a process called creation and redemption. Authorized participants (APs) create ETF shares by depositing gold with the fund. These shares can then be traded on stock exchanges. When an AP wants to redeem shares, they can exchange them for the underlying gold.

Pricing Mechanisms The price of a Gold ETF share typically reflects the current gold price. Market makers and arbitrageurs play a crucial role in keeping the ETF price aligned with the gold spot price by exploiting price discrepancies.

Role of Gold Prices Gold prices are influenced by various factors including economic data, geopolitical events, inflation rates, and currency fluctuations. Consequently, the value of Gold ETFs fluctuates with the price of gold.

Benefits of Investing in Gold ETFs

Ease of Trading Gold ETFs are traded on stock exchanges, making them as easy to buy and sell as any other stock. Investors can trade them during market hours at market prices.

Lower Costs Compared to Physical Gold Investing in physical gold involves costs related to storage, insurance, and security. Gold ETFs eliminate these costs, providing a more economical way to gain exposure to gold.

Liquidity Gold ETFs offer high liquidity as they can be bought and sold on the stock exchange. This makes them a flexible investment option, especially in comparison to physical gold, which can be harder to liquidate quickly.

Risks and Considerations

Market Volatility Gold ETFs are subject to market volatility. While gold is generally considered a safe-haven asset, its price can still experience significant fluctuations due to market sentiment and macroeconomic factors.

Impact of Economic Factors Factors such as interest rates, inflation, and currency strength can impact gold prices and, by extension, Gold ETFs. Investors need to be aware of these influences when considering their investments.

Taxation and Fees

Tax Implications Gold ETFs are treated as collectibles for tax purposes in many jurisdictions. This means they may be subject to higher capital gains tax rates compared to other investments. It’s essential to understand the specific tax treatment in your country.

Associated Fees While Gold ETFs are cost-effective compared to physical gold, they are not free from expenses. Investors should be aware of the expense ratio, which covers management fees and other operational costs of the ETF. There might also be brokerage fees for buying and selling shares.

Comparison with Other Gold Investment Options

Gold Mutual Funds Gold mutual funds invest in a diversified portfolio of gold-related assets, including stocks of gold mining companies and sometimes physical gold. They provide professional management but come with higher fees and less direct exposure to gold prices compared to Gold ETFs.

Stocks of Gold Mining Companies Investing in gold mining companies offers leveraged exposure to gold prices. However, the performance of these stocks is also influenced by company-specific factors such as management efficiency and operational costs, making them more volatile than Gold ETFs.

Physical Gold Physical gold provides direct exposure and is often seen as a tangible asset. However, it involves higher costs for storage and security, and it can be less liquid compared to Gold ETFs.

How to Invest in Gold ETFs

Step-by-Step Guide

Open a Brokerage Account: To invest in Gold ETFs, you need a brokerage account. Choose a reputable broker that offers access to the stock exchanges where Gold ETFs are listed.

Research and Select an ETF: Research various Gold ETFs, considering factors such as expense ratios, liquidity, and the fund’s underlying assets.

Place an Order: Once you have selected a Gold ETF, place a buy order through your brokerage account. You can choose between a market order or a limit order.

Monitor Your Investment: Keep track of your Gold ETF investment, considering market conditions and economic indicators that influence gold prices.

Performance Analysis

Historical Performance Historically, Gold ETFs have mirrored the performance of gold prices. During periods of economic uncertainty, gold prices—and consequently Gold ETFs—tend to perform well as investors seek safe-haven assets.

Response to Market Conditions Gold ETFs have shown resilience in turbulent market conditions, often outperforming other asset classes during economic downturns. However, during periods of strong economic growth, their performance might lag as investors shift to riskier assets.

See also What Is The Cost Of Gold Biscuit? All You Need to Know

Gold ETFs and Portfolio Diversification

Diversification Benefits Gold ETFs offer significant diversification benefits due to their low correlation with other asset classes like equities and bonds. Including Gold ETFs in an investment portfolio can reduce overall risk and volatility.

Strategic Allocation Investors often use Gold ETFs as part of a strategic asset allocation to hedge against inflation and economic uncertainties. The optimal allocation to gold in a diversified portfolio depends on individual risk tolerance and investment goals.

See also Gold ETF Or Gold Fund: Which Is Better

Future Outlook

Current Market Trends As of recent years, Gold ETFs have gained popularity due to economic uncertainty, inflation concerns, and geopolitical tensions. The increasing demand for safe-haven assets has supported their growth.

Future Prospects The future outlook for Gold ETFs is generally positive, given the persistent economic uncertainties and inflationary pressures. However, investors should remain cautious of potential volatility and market dynamics.

In conclusion, Gold ETFs offer a convenient, cost-effective, and liquid way to invest in gold. They provide diversification benefits and can serve as a hedge against economic uncertainty. However, like all investments, they come with risks that need to be carefully considered. By understanding the workings, benefits, risks, and strategic uses of Gold ETFs, investors can make informed decisions to meet their financial goals.