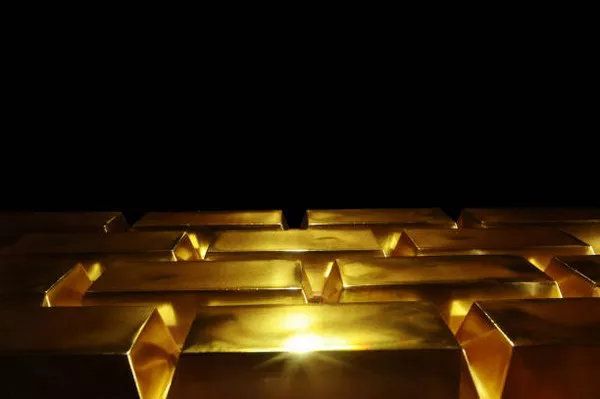

Gold prices continued their upward trajectory on Thursday, staying close to a record high achieved in the previous session, driven by expectations of a U.S. interest rate cut in September.

At 0218 GMT, spot gold edged up 0.1% to $2,461.27 per ounce, after reaching an all-time peak of $2,483.60 on Wednesday. U.S. gold futures also rose 0.2%, trading at $2,465.00.

Ryan McIntyre, senior portfolio manager at Sprott Asset Management, highlighted that the prospects of lower interest rates and uncertainties surrounding the U.S. elections are key factors likely to propel gold prices beyond $2,500. Gold typically thrives amid economic and geopolitical uncertainties.

McIntyre noted a rebound in gold holdings in ETFs since May, signaling renewed interest from financial advisors and institutions.

The appeal of gold, a non-yielding asset, increases in environments of declining interest rates. Federal Reserve officials, including Fed Governor Christopher Waller and New York Fed President John Williams, have hinted at potential monetary easing, with markets anticipating a 25 basis point rate cut in September according to CME’s FedWatch Tool.

A recent Fed survey indicated slight to modest economic expansion from late May to early July, with businesses anticipating slower growth ahead.

Looking ahead, Citi Research forecasts bullish trajectories for gold and silver, predicting gold to rise to $2,700-$3,000 and silver to $38 over the next 6-12 months, irrespective of the U.S. election outcome.

Amid concerns of a global trade war, particularly between the U.S. and China, investors are considering precious metals like gold and silver as hedges against equity and currency risks, further supporting their prices.

In the broader metals market, spot silver gained 0.2% to $30.35 per ounce, platinum held steady at $994.81, and palladium rose 0.4% to $955.77.

The steady climb in gold prices underscores its safe-haven appeal amid economic uncertainties and anticipations of monetary policy adjustments, setting a bullish tone for precious metals markets.