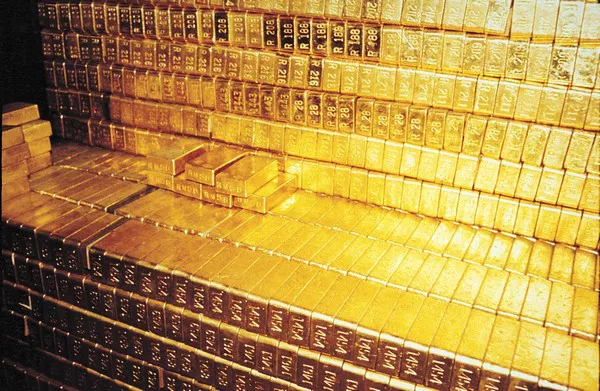

Gold has emerged as a standout performer among commodities this year, marking an impressive 18.5% gain and reaching record highs. However, this success story may face a twist, as escalating prices threaten consumer buying sentiments.

On August 2, spot gold closed at $2,443.29 per ounce, maintaining substantial gains achieved throughout the year, culminating in an all-time peak of $2,483.60 on July 17.

The latest quarterly report from the World Gold Council unveiled a robust total demand of 1,258.2 metric tons in the second quarter, marking a record high for the period and a 4% increase from the same timeframe in 2023. Yet, a closer look at the demand breakdown hints at potential slowdowns in the upcoming quarters.

Of particular note is the significant surge in Over-The-Counter (OTC) market demand, primarily driven by institutional investors, high net-worth individuals, and family offices. OTC demand soared to 329.2 tons in the second quarter, marking a 53% rise from the previous year and an astounding 385% leap from the first quarter.

This surge, attributed to “portfolio diversification,” raises questions regarding the sustainability of this demand, as investors may scale back purchases once they perceive their gold allocations as adequate.

The report also highlighted a stark decline in jewelry consumption, plummeting to 390.6 tons in the second quarter, a 19% decrease from the same period in 2023. Concurrently, official coin demand experienced a sharp 38% drop to 52.7 tons during the same period, potentially reflecting consumer hesitancy due to the steep price upsurge.

Notably, concerns loom over jewelry demand in China and India, the largest consumers of physical gold globally. China witnessed a 35% decline in jewelry demand to 86.3 tons, while India recorded a 17% decrease to 106.5 tons.

In China, a notable indicator of declining gold interest was the 18% reduction in net imports through Hong Kong in June, underscoring potential waning demand in the top consumer market.

Despite India’s recent reduction of import duties from 15% to 6%, expected to boost consumer demand, this move is likely to yield a transient uptick rather than a sustained shift.

The rise in gold prices also appears to have impacted flows into Exchange Traded Funds (ETFs), with a net decrease of 7.2 tons in the second quarter following a larger decline of 113 tons in the first.

Additionally, central bank purchases moderated in the second quarter to 183.4 tons, down from 299.9 tons in the preceding quarter but displaying a 6% increase from the second quarter of 2023.

While the surge in gold prices may impede price-sensitive demand, factors such as anticipated monetary policy easing in key economies and geopolitical tensions are expected to sustain investor interest in the metal.

The interplay between bearish and bullish elements in the gold market could likely maintain price stability within a relatively narrow range for the remainder of the year, amidst global uncertainties and evolving economic landscapes.