In the Asian trading session on Tuesday, gold prices exhibited a minor decline but remained in close proximity to all-time highs, buoyed by escalating geopolitical uncertainties and mounting speculation surrounding potential interest rate cuts by the Federal Reserve (Fed).

Markets adopted a risk-averse stance in anticipation of pivotal U.S. inflation data releases scheduled for this week, which are poised to play a pivotal role in shaping expectations regarding future interest rate adjustments.

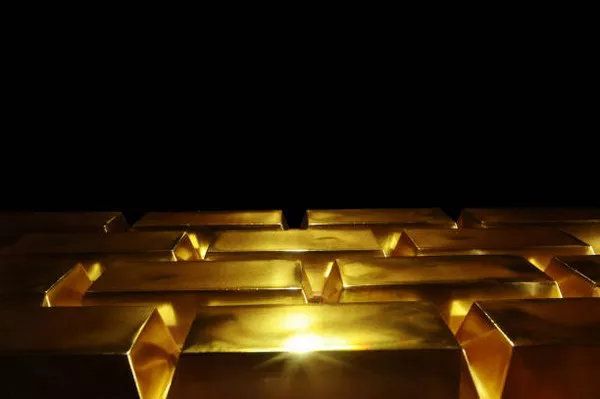

Spot gold retreated by 0.4% to $2,460.78 per ounce, while December gold futures dipped by 0.1% to $2,501.45 per ounce by 00:56 ET (04:56 GMT). Earlier, gold futures had surged to a record peak of $2,517.10 per ounce, while spot prices lingered close to a record high of $2,483.78 per ounce.

The ongoing tensions between Iran and Israel have contributed to a surge in safe-haven demand for gold, with reports indicating the potential for an Iranian strike against Israel following the recent assassination of a Hamas leader in Iran. The mounting conflicts in the region and the looming threat of a broader Middle Eastern conflict have reinforced gold’s allure as a safe-haven asset.

The forthcoming release of the U.S. Consumer Price Index (CPI) data on Wednesday has captured market attention, with expectations leaning towards a marginal easing in inflation figures for July. A softer inflation reading is anticipated to reinforce expectations of impending U.S. interest rate cuts, particularly amidst apprehensions of a looming economic downturn.

Market sentiments appear divided regarding the extent of potential rate cuts in September, with Wednesday’s CPI data release expected to provide further clarity on this front. Additionally, industrial production and retail sales data releases will offer additional insights into the economic landscape throughout the week.

While broader precious metal prices experienced declines on Tuesday, they retained some of the gains accumulated earlier in the week. Platinum futures saw a 0.7% decline to $942.60 per ounce, while silver futures slipped by 0.8% to $27.773 per ounce.

In the realm of industrial metals, copper prices faced downward pressure on Tuesday due to persistent concerns surrounding China, the largest global importer of copper. Benchmark copper futures on the London Metal Exchange fell by 0.7% to $8,963.50 per ton, with one-month copper futures also decreasing by 0.7% to $4.0418 per pound.

The forthcoming focus will be on the industrial production and retail sales data releases from China on Thursday, which are expected to provide critical economic indicators concerning the world’s primary copper importer. These data readings follow a series of lackluster data releases from China, heightening concerns regarding the country’s appetite for copper.