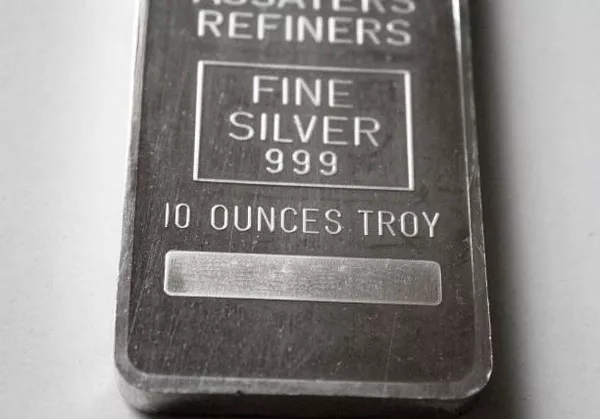

Silver (XAG/USD) continues its upward trajectory, trading at approximately $31.10 per troy ounce on Friday, marking a second consecutive day of gains. The non-yielding metal has found support following the US Federal Reserve’s significant 50 basis point rate cut announced on Wednesday.

Expectations for further rate reductions by the Fed through the end of 2024 are also influencing silver demand. Recent projections from the Fed’s dot plot indicate a gradual easing cycle, with the median rate for 2024 adjusted down to 4.375% from June’s forecast of 5.125%.

In a lower interest rate environment, silver becomes increasingly attractive to investors, as the opportunity cost of holding the precious metal decreases, potentially allowing for better returns compared to other assets.

Globally, the People’s Bank of China (PBoC) maintained its one-year Loan Prime Rate (LPR) at 3.35%, while the Bank of Japan (BoJ) held its interest rate steady at 0.15% on Friday. Similarly, the Bank of England (BoE) opted to keep its rate at 5%, as widely anticipated.

Additionally, safe-haven demand for silver has been heightened by rising tensions in the Middle East. Israeli warplanes launched their most intense strikes on southern Lebanon in nearly a year late Thursday, prompting the White House to emphasize the urgency of a diplomatic resolution. Britain has also called for an immediate ceasefire between Israel and Hezbollah, according to reports.