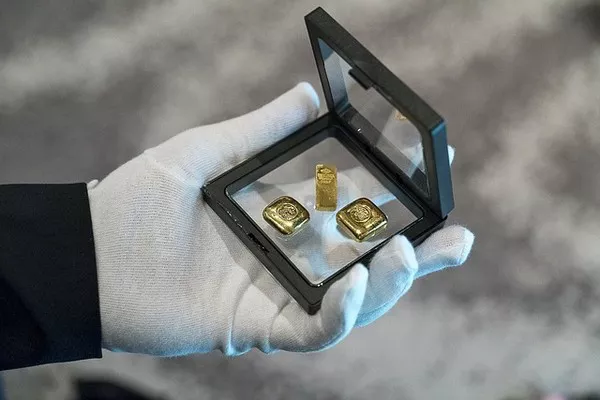

The gold market remains robust, trading close to its recent record highs above $2,700 an ounce, even as new data reveals resilience in the U.S. labor market, with first-time unemployment claims dropping more than anticipated.

According to the U.S. Labor Department’s report on Thursday, initial claims for state unemployment benefits decreased by 4,000, landing at a seasonally adjusted 218,000 for the week ending September 21. This figure was notably lower than the consensus estimate, which predicted 224,000 claims for the week.

Additionally, the previous week’s unemployment claims were revised upward by 3,000, now standing at 222,000.

Despite this positive employment data, the gold market has shown little volatility, maintaining prices close to its overnight highs. As of the latest update, December gold futures were trading at $2,695 an ounce, reflecting a 0.38% increase for the day.

In other labor market metrics, the four-week moving average for new claims—a figure that provides a clearer picture by smoothing out weekly fluctuations—came in at 224,750, down 3,500 claims from the revised figure of 228,250 the previous week.

Continuing claims, which indicate the number of individuals currently receiving unemployment benefits, rose to 1.834 million for the week ending September 14, an increase from the previously revised total of 1.821 million.

You Might Be Interested In

- Gold Reaches Record High of $2,685 Amid Positive Economic Signals and Geopolitical Tensions

- Gold Prices Hold Steady Near Record Highs Ahead of Powell’s Address

- Gold Reaches New All-Time High as Global Tensions and Rate Cuts Fuel Demand