Despite signs of a slowdown, the labor market remains resilient, with job creation outpacing the growth necessary to accommodate the increasing population.

The U.S. economy is approaching the targets set by the Federal Reserve, indicating steady progress. However, the current inflation rate continues to be significantly above the desired 2% threshold. While the Fed maintains a sharp focus on controlling inflation, the health of the job market remains an important factor in economic considerations.

There are concerns that the strength of the economy could complicate efforts to recalibrate monetary policy. Many businesses have reported a shift in consumer behavior, noting that increased price sensitivity among buyers has limited their ability to raise prices.

Looking ahead, Hurricanes Helene and Milton may have substantial economic impacts in the next three to six months. Additionally, ongoing shifts in supply chains are expected to alter business cost structures, a development that the Federal Reserve will need to closely monitor and understand.

You Might Be Interested In

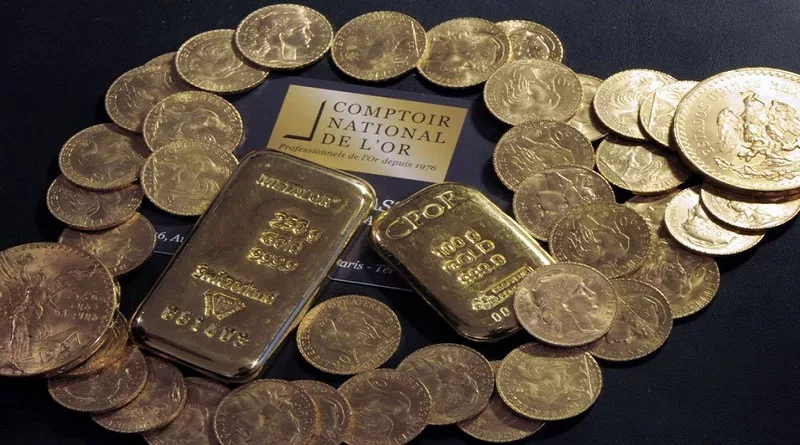

- Hedge Funds Target Argentina’s Central Bank Gold Reserves Following Controversial Transfer

- India’s Gold Imports Surge to Highest Level Since 2021; Silver Coin Sales Lag Behind 2023 Pace

- China Holds Steady on Gold Reserves as PBoC Pauses Purchases for Fifth Month