Selling physical gold can be a significant financial decision, whether you’re looking to liquidate an investment, downsize your collection, or simply cash in on an inherited asset. Understanding the process, market dynamics, and potential pitfalls is crucial to ensuring a smooth transaction and obtaining the best possible price. This article will guide you through the steps to sell physical gold effectively, covering everything from preparation to finding the right buyer.

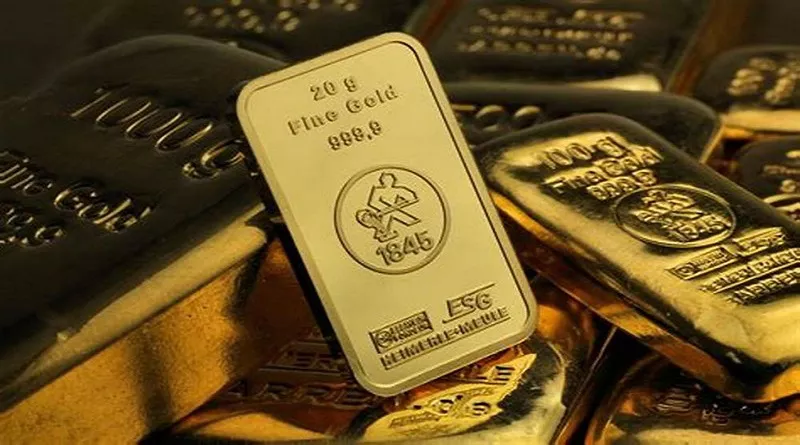

Gold has long been regarded as a valuable asset, serving as a hedge against inflation and economic uncertainty. As a tangible form of wealth, physical gold—whether in the form of coins, bars, or jewelry—can be sold for cash or reinvested. However, navigating the selling process requires knowledge of the market, the types of gold you own, and the various selling options available.

Understanding Your Gold

Before you embark on selling your gold, it’s essential to understand exactly what you have. This includes the type of gold, its purity, and its market value.

Types of Physical Gold

Gold Coins: These can be collectible or bullion coins, such as the American Gold Eagle, Canadian Maple Leaf, or Krugerrand. Their value may be based on both their gold content and collector demand.

Gold Bars: Often purchased as an investment, gold bars come in various sizes and are typically stamped with their weight and purity.

Gold Jewelry: While this may have sentimental value, its worth is often determined by the gold content and craftsmanship rather than the original purchase price.

Purity and Weight

Gold is measured in karats (K), with 24K being pure gold. It’s crucial to know the purity of your gold, as this directly affects its value. Additionally, understanding the weight of your gold in troy ounces (the standard unit for measuring precious metals) will help you gauge its market value.

Market Value

The market price of gold fluctuates based on supply and demand, geopolitical factors, and economic conditions. Keep an eye on the current gold prices, which can be tracked through financial news outlets or commodities exchanges.

Preparing to Sell Your Gold

Once you understand your gold, the next step is preparation.

Documentation

Gather any certificates of authenticity, appraisals, or receipts you have. This documentation can help verify the purity and provenance of your gold, which may increase its value.

Clean Your Gold

While it’s essential to maintain the integrity of your gold, cleaning jewelry can enhance its appearance. Use a mild soap and a soft cloth to clean your gold items. However, avoid harsh chemicals or aggressive cleaning methods, especially on antique or delicate pieces.

Assessing Value

Consider getting a professional appraisal for valuable items, especially gold jewelry or coins. An appraiser can provide a detailed report on the piece’s worth based on market conditions, craftsmanship, and historical significance.

Selling Options

There are several avenues through which you can sell physical gold. Each option has its pros and cons, and the best choice depends on your specific circumstances.

1. Local Jewelers

Pros:

Quick transactions.

Immediate cash payment.

Cons:

May offer lower prices compared to other options.

Limited expertise in specialized gold items.

Local jewelers can be convenient for quick sales, especially if you’re selling gold jewelry. However, it’s advisable to compare offers from multiple jewelers to ensure you receive a fair price.

2. Gold Buyers

Pros:

Specialized in buying precious metals.

Often provide competitive prices.

Cons:

Can be less personal than local jewelers.

Some may charge fees for their services.

Gold buying businesses or pawn shops often specialize in purchasing gold and can provide an immediate cash offer. However, research the reputation of the buyer to avoid scams.

3. Online Gold Buyers

Pros:

Potentially higher offers.

Convenient and accessible.

Cons:

Shipping your gold involves risk.

Processing times can vary.

Many online platforms allow you to sell gold conveniently. However, ensure you use a reputable buyer with positive reviews. Understand their policies regarding shipping, insurance, and payment processing.

4. Auctions

Pros:

Potential for higher prices on unique or collectible items.

Access to a broader audience.

Cons:

Auction fees can eat into profits.

No guarantee of sale.

If you have unique or rare items, consider selling them at auction. Research the auction house’s fees and policies before proceeding.

5. Selling to Collectors

Pros:

Potential for better prices on collectible items.

Direct transactions.

Cons:

May require more time and effort to find the right buyer.

Negotiation skills may be necessary.

If you own collectible coins or jewelry, selling directly to collectors can yield higher prices. Use online forums, social media, or collector groups to connect with potential buyers.

Negotiating the Sale

Know Your Worth

Be prepared with the current market value of your gold and any relevant documentation to support your asking price. Knowledge is your best asset when negotiating.

Be Open to Offers

While it’s essential to have a target price in mind, be open to negotiations. Buyers may offer less than your asking price, and understanding their perspective can help you find common ground.

Finalizing the Sale

Once you agree on a price, ensure you receive payment before handing over the gold. Depending on the selling method, this may involve cash, a bank transfer, or a check.

Tax Implications

Selling physical gold may have tax implications. In many countries, profits from selling gold are subject to capital gains tax. Keep accurate records of your purchase prices and selling prices to report on your tax returns accurately. Consult a tax professional for personalized advice.

Protecting Yourself from Scams

Research Buyers

Always research potential buyers before selling your gold. Look for reviews, check for proper licensing, and ensure they have a good reputation.

Get Multiple Quotes

Don’t settle for the first offer. Obtain quotes from several buyers to ensure you’re getting a fair price.

Trust Your Instincts

If something feels off or too good to be true, it probably is. Trust your instincts and proceed with caution.

Conclusion

Selling physical gold can be a rewarding experience, but it requires careful preparation and consideration. By understanding your gold, exploring different selling options, and knowing how to negotiate effectively, you can maximize your return. Always be vigilant about potential scams and aware of the tax implications of your sale. Whether you’re liquidating an investment, selling an heirloom, or simply cashing in, informed decisions will help you navigate the gold selling process successfully.

Related topics:

- Which Karat Gold Is Best for Rings? A Comprehensive Guide

- Silver vs. Gold: Which Metal is Rarer?

- Physical Gold vs. Gold Stocks: Which Is the Better Investment?