Sanu Gold Corp has launched its 2024 Phase 1 drilling campaign at the Daina gold exploration permit, located in Guinea’s Siguiri Basin, a region known for its significant gold deposits. The drilling program is focused on five key targets: Daina 1 South, Daina 1 North, Daina 2, Daina 6, and the newly identified Salat East target. These sites were selected based on favorable results from previous auger-hole sampling and geophysical surveys, with some targets showing potential strike lengths of up to three kilometers.

Targeted Exploration and High-Grade Intercepts

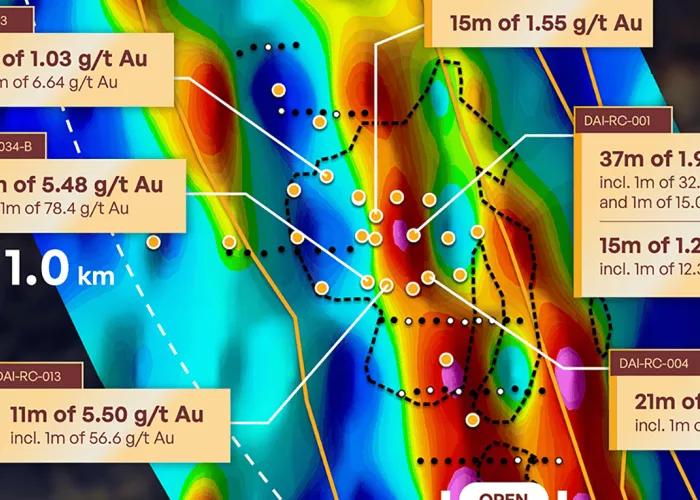

The primary goal of the drilling campaign is to assess these five targets, including new areas like the Salat East discovery. The program also aims to follow up on previous high-grade intercepts from earlier drilling at Daina 2, which returned significant results such as 21 meters of 4.75 grams per tonne (g/t) gold, including one meter at 85.5 g/t, and 15 meters of 5.48 g/t gold, with a high-grade section of 78.4 g/t gold.

Strategic Location and Emerging District

The Daina permit is strategically located near large-scale gold exploration projects operated by major mining companies such as AngloGold Ashanti, Resolute Mining, and Endeavour Mining. These companies are actively exploring neighboring sites, which enhances the geological understanding of the region’s gold mineralization. AngloGold Ashanti is also a strategic shareholder in Sanu Gold.

2024 Drilling Campaign Details

The Phase 1 drilling campaign, which began on November 8, 2024, involves up to 3,000 meters of air core and reverse circulation (RC) drilling, across 25 to 35 holes. This marks the first phase of drilling at Daina, with the company targeting previously identified high-grade zones while also exploring new areas that hold significant potential.

Assays Pending from Diguifara Permit

Sanu Gold has completed its initial drilling campaign at the Diguifara permit, with assays from all 22 holes still pending. The results will provide additional insight into the geological characteristics of this area as the company expands its operations in Guinea.

CEO Statement on Progress

Martin Pawlitschek, President and CEO of Sanu Gold, commented on the company’s progress: “With the initial phase of drilling at Diguifara now complete, totaling 2,000 meters in 30 holes, we are excited to move forward with drilling at Daina. The combination of auger gold results, rock chip sampling, and ground geophysics has allowed us to better understand key targets, many of which remain largely untested.”

Gold Market Dynamics

Sanu Gold’s exploration efforts are aligned with the broader trends in the gold market, which have seen significant price rallies in 2024. According to Kitco’s October 29 report, gold futures approached US$2,800 per ounce, driven by geopolitical instability and robust central bank demand. Kitco highlighted that emerging market central banks have been active buyers of gold, seeking to reduce reliance on the U.S. dollar amid global uncertainties.

A similar analysis by Yahoo! Finance on November 5 pointed to gold’s ongoing rally as a signal of deeper economic and geopolitical challenges. Ambrose Evans-Pritchard of Yahoo! Finance suggested that gold’s rise is linked to fiscal instability and global economic pressures, stating that “gold is rising onwards and upwards with scarcely a pause for breath.”

On November 11,gold’s rally has been further supported by the Federal Reserve’s rate cuts, reaching US$2,744 an ounce by late October. The report cited increased geopolitical risks, the upcoming U.S. presidential election, and central bank buying as key factors driving gold’s continued upward trajectory.

Sanu Gold’s ongoing drilling efforts at the Daina gold exploration permit come at a time when gold continues to be seen as a key asset for wealth preservation during periods of financial uncertainty.

Related topics:

- Gold Prices Drop Rs 2,500 Per Tola in Pakistan

- Gold Prices Decline from Record Highs in India on November 1

- India’s Gold Reserves Surge: RBI Reports 60% Increase in Domestic Holdings