Physically backed gold exchange-traded funds (ETFs) registered their largest weekly inflow since March 2022, data from the World Gold Council (WGC) revealed on Monday.

Gold ETFs, which store bullion for investors, play a crucial role in the demand for the precious metal, which recently hit a record high of $2,956.15 per troy ounce.

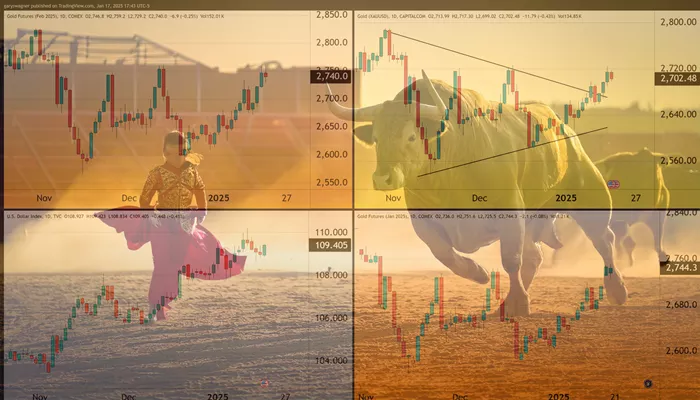

Last week, gold ETFs experienced an inflow of 52.4 metric tons, valued at $5 billion, marking the largest such inflow since the first week of March 2022. This surge occurred as global markets were grappling with the initial fallout from Russia’s invasion of Ukraine. As a result, total gold ETF holdings rose by 1.6% to 3,326.3 tons, the highest level since August 2023.

U.S.-listed funds led the charge, receiving 48.7 tons of the total inflow. This was a significant rebound after January, when these funds experienced an outflow of 6.3 tons.

Related topics:

- Knowing the Weight of Gold: How Many Grams in a Troy Ounce?

- Why Are Gold Coins Different Prices?

- How to Know Gold Purity?