Gold prices may reach a record high of $3,500 an ounce by the third quarter of 2025, driven by growing safe-haven demand, according to analysts at Macquarie Group. In a recent note, analysts, led by Marcus Garvey, projected that gold could average $3,150 an ounce over the period.

As of Thursday, gold was trading at approximately $2,940 an ounce, and the precious metal is expected to find further support from concerns about the U.S. budget deficit. Macquarie analysts highlighted that a deteriorating U.S. budget outlook could signal rising inflation, further cementing gold’s position as a hedge against economic instability.

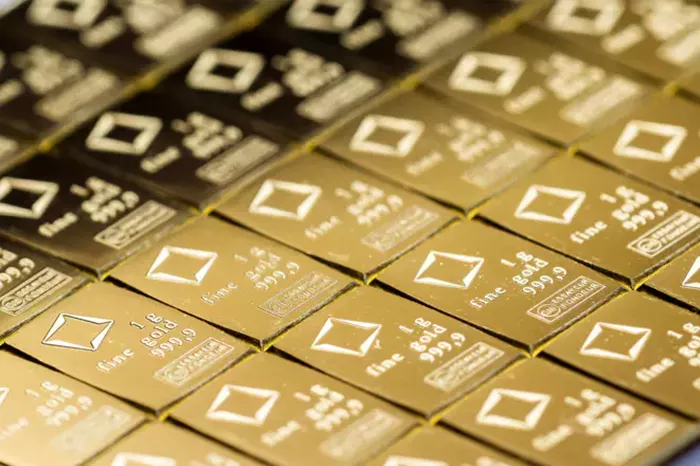

Gold has already climbed 12% this year, fueled by geopolitical uncertainties and U.S. President Donald Trump’s tariff policies.

“We view gold’s price strength to date, and our expectation for it to continue, as primarily being driven by investors’ and official institutions’ greater willingness to pay for its lack of credit or counterparty risk,” the analysts stated.

Macquarie also noted that there is “ample scope” for exchange-traded funds (ETFs) backed by gold to increase holdings. Additionally, physical gold demand, including for jewelry, bars, coins, and technology, remains robust despite high prices.

Goldman Sachs recently raised its year-end gold target to $3,100 an ounce, while Citigroup has forecasted prices reaching $3,000 an ounce within the next three months.

Related topics:

- India Surpasses China in Gold Purchases, Buying 51% More in Three Months

- Qilu Bank Enhances Support for Small Businesses with Innovative Financial Tools

- Bitcoin Poised for a Surge Amid Gold’s Delivery Delays, Expert Claims