GOLD, SILVER, RETAIL TRADER POSITIONING, TECHNICAL ANALYSIS – IGCS COMMODITIES UPDATE

- Gold and silver prices continue lower, retail traders more bullish

- From a contrarian standpoint, this is an increasingly bearish view

- Death Crosses might be on the horizon soon using the daily setting

Gold and silver prices continued aiming lower in recent days, accelerating a decline since finding a top in late April. By looking at IG Client Sentiment (IGCS), we can see how retail traders have been evolving their exposure in these precious metals. IGCS tends to function as a contrarian indicator, especially in trending markets. With that in mind, could further pain be in store for XAU/USD and XAG/USD?

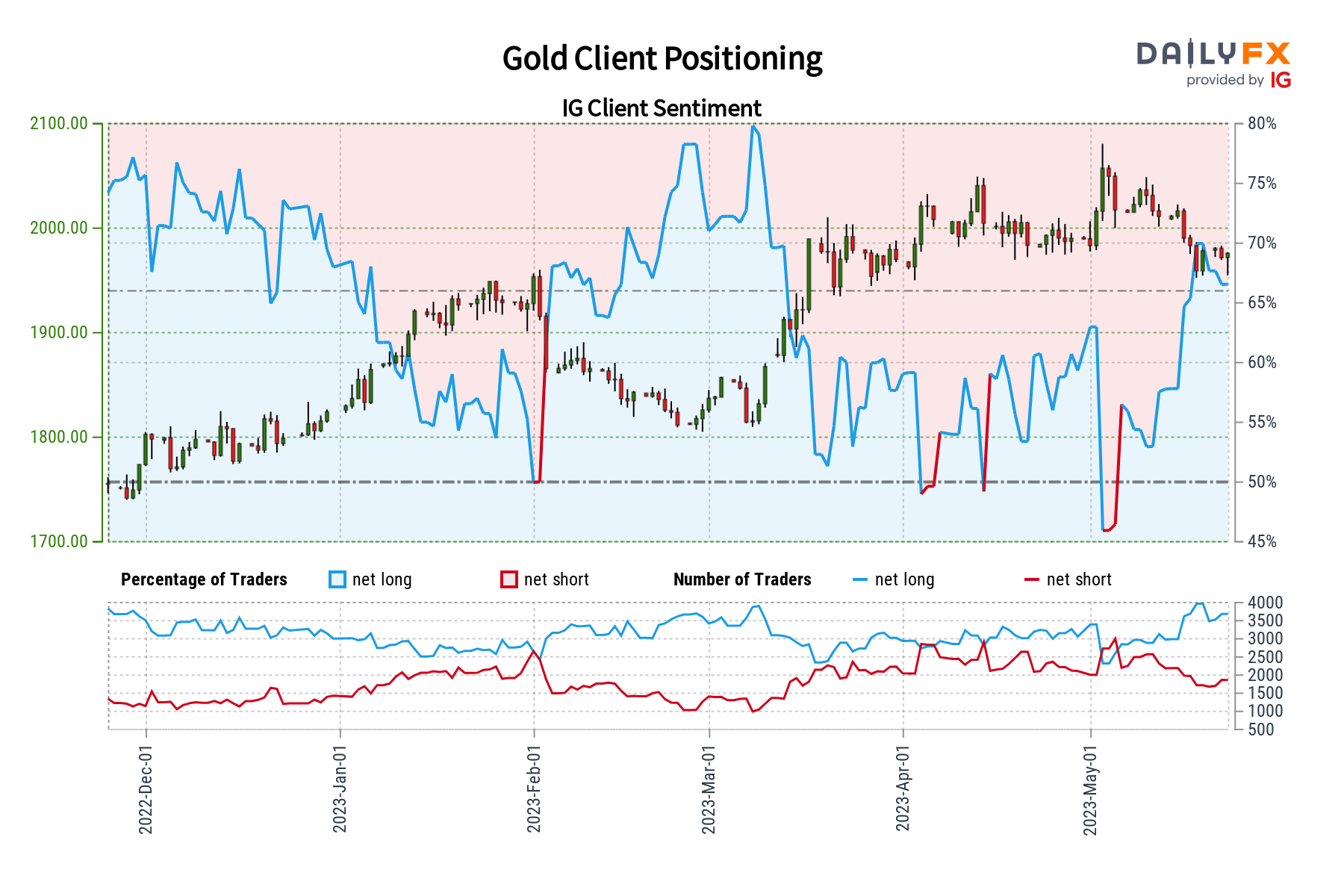

Gold Sentiment Outlook – Bearish

The IGCS gauge shows that about 66% of retail traders are net-long gold. Since most of them are biased higher, this hints that prices may continue falling. This is as upside exposure increased by 1.79% and 12.32% compared to yesterday and last week, respectively. With that in mind, the combination of current sentiment and recent changes offers a stronger bearish contrarian trading bias.

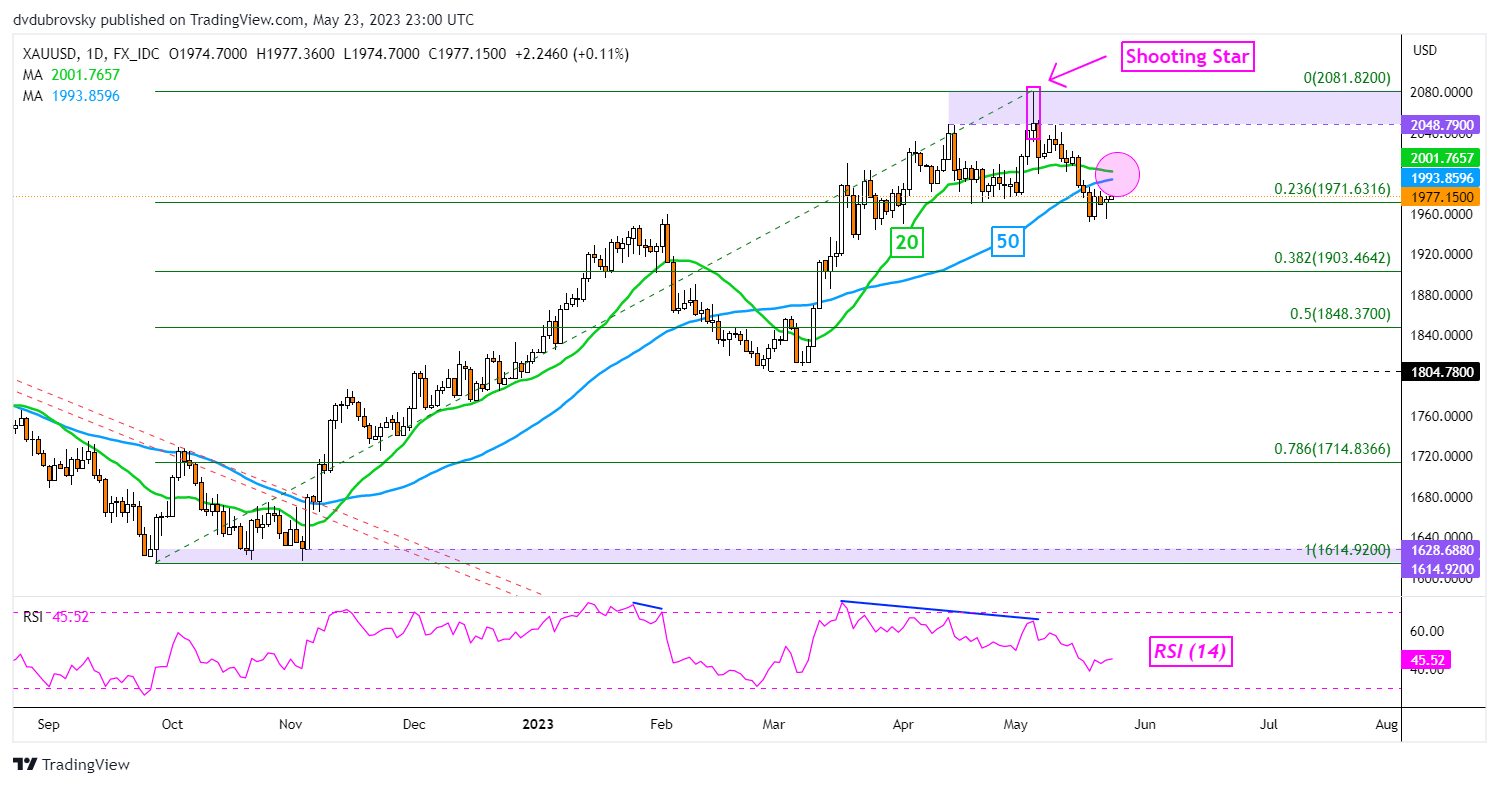

XAU/USD Daily Chart

On the daily chart, a bearish Death Cross between the 20- and 50-day moving averages could be in store for gold. This is as prices are testing the 23.6% Fibonacci retracement level at 1971. Confirming a downside breakout exposes the 38.2% level at 1903. Otherwise, a turn higher places the focus on current 2023 highs, making for a wide range of resistance between 2048 – 2081.

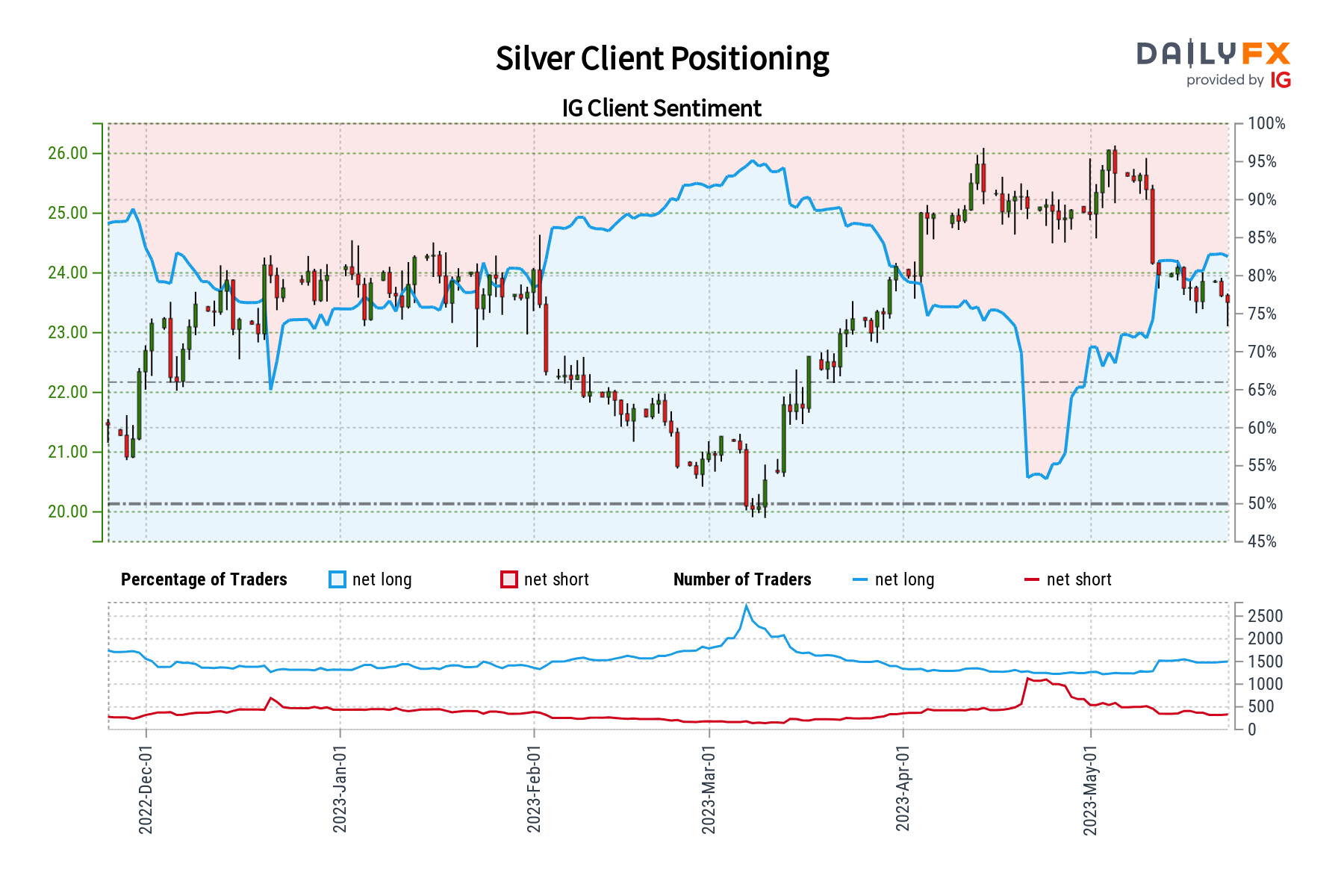

Silver Sentiment Outlook – Bearish

The IGCS gauge reveals that roughly 83% of retail traders are net-long silver. Since most of them are net-long, this hints that prices may continue falling. This is as downside exposure decreased by 2.6% and 24.81% compared to yesterday and last week, respectively. With that in mind, this is producing a stronger bearish contrarian trading bias.

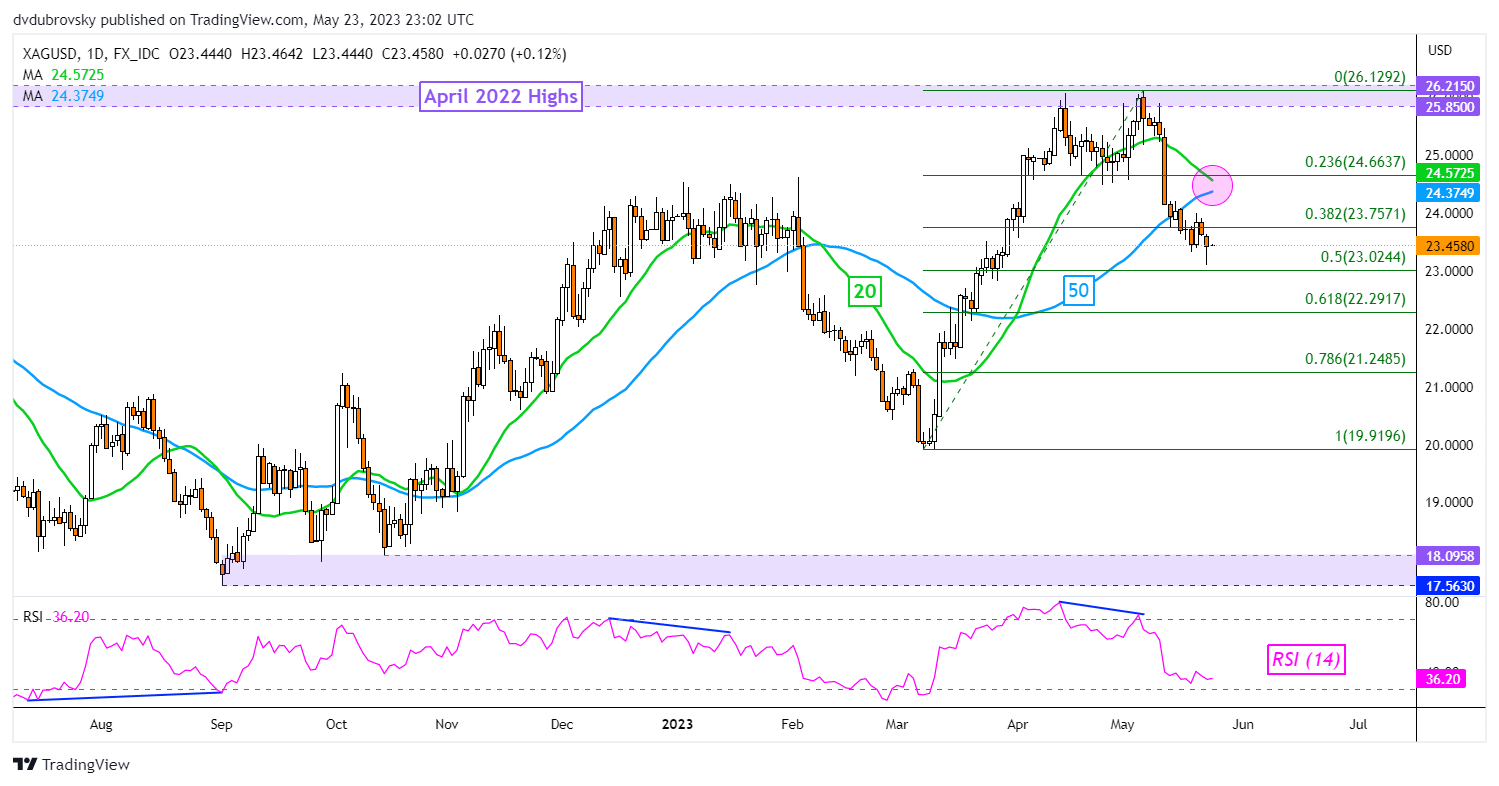

XAG/USD Daily Chart

A bearish Death Cross between the same moving averages may also be in store for silver soon. That would open the door to an increasingly downside technical bias. Immediate support is the midpoint of the Fibonacci retracement at 23.02. Extending lower exposes the 61.8% point at 22.2917. Otherwise, a turn higher places the focus on the 38.2% level at 23.757.