Trading in MCX (Multi Commodity Exchange) gold futures provides investors and traders with an opportunity to participate in the dynamic world of commodities markets. MCX is India’s leading commodity exchange, and gold futures are among the most actively traded contracts on the platform. In this article, we will explore the intricacies of trading in MCX gold futures and provide you with valuable insights to enhance your trading strategies and decision-making.

-

Understanding MCX Gold Futures:

MCX gold futures represent a standardized agreement to buy or sell a specific quantity of gold at a predetermined price, with delivery and settlement taking place on a future date. These contracts provide market participants with a means to speculate on the price movement of gold and manage risks associated with price fluctuations.

-

Conducting Fundamental Analysis:

Fundamental analysis plays a crucial role in comprehending the factors that impact gold prices. Keep track of economic indicators such as inflation rates, interest rates, geopolitical tensions, and central bank policies as they greatly influence gold prices. Additionally, monitor supply and demand dynamics, global gold production, and changes in gold consumption patterns.

-

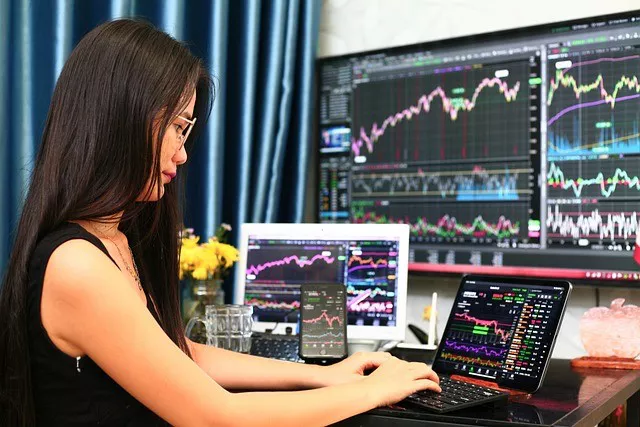

Technical Analysis and Charting:

Technical analysis involves studying historical price data and identifying patterns, trends, and support and resistance levels using charts and indicators. Utilize tools such as moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and Fibonacci retracements to gauge potential entry and exit points. Combining technical analysis with fundamental insights can enhance trading decisions.

-

Risk Management:

Implementing a robust risk management strategy is vital for successful trading. Determine the amount of capital you are willing to risk on each trade, and set stop-loss orders to limit potential losses. Additionally, utilize profit targets to secure profits at predefined levels. Regularly review and adjust risk parameters based on market conditions.

-

Developing a Trading Plan:

A well-defined trading plan is the foundation of successful trading. It should include criteria for entering and exiting trades, risk management guidelines, and rules for adjusting strategies based on changing market conditions. Stick to your trading plan and avoid making impulsive decisions driven by emotions.

-

Choosing the Right Timeframe:

Selecting the appropriate timeframe for your trading style is crucial. Short-term traders might focus on intraday or daily charts, while long-term investors may consider weekly or monthly charts. Align your trading timeframe with your trading goals, risk tolerance, and available time for analysis.

-

Keeping an Eye on Market News:

Stay updated with the latest news and events that impact gold prices. Follow global economic developments, policy decisions, and announcements from major central banks. News releases such as GDP reports, employment data, and geopolitical events can trigger significant price movements.

-

Practicing on Demo Accounts:

Before venturing into live trading, practice your strategies on demo accounts provided by brokers or trading platforms. Demo accounts allow you to test your trading ideas, understand the platform’s functionalities, and gain confidence in your abilities without risking real money.

-

Continuous Learning:

The financial markets are dynamic and constantly evolving. Stay committed to continuous learning and improvement by reading books, attending webinars, following expert analysis, and participating in online trading communities. Surround yourself with like-minded individuals who can provide valuable insights and support.

-

Reviewing and Analyzing Trades:

Regularly review your trades to identify patterns and learn from both successful and unsuccessful trades. Analyze your decisions, entry and exit points, and market conditions. Maintain a trading journal to record your thoughts, emotions, and observations, which can be invaluable for refining your trading strategies.

Conclusion:

Trading in MCX gold futures requires a combination of fundamental and technical analysis, risk management skills, and a disciplined approach. By understanding market dynamics, developing a trading plan, and continuously improving your skills, you can navigate the complexities of MCX gold futures trading and increase your chances of success. Remember, patience, discipline, and a thirst for knowledge are key to achieving consistent profitability in the commodities market.