GOLD (XAU/USD) PRICE, CHARTS AND ANALYSIS:

- Gold (XAU/USD) Bounces Off 100-Day MA as DXY Retreats.

- US Debt Ceiling Deal Awaiting Approval from Members of Congress. Has the DXY Peaked?

- Daily Candle Close Above the $1950 Handle Needed for Bullish Continuation.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Gold prices retreated in Asian trade as the Dollar Index (DXY) printed fresh highs this morning. XAU/USD has since found support at the 100-day MA around the $1936/oz handle at the start of the European session.

DOLLAR INDEX AND DEBT CEILING DEAL

Given yesterday’s Bank holiday in the US and UK, market participants will do doubt be keeping a close eye on the reaction to the US debt ceiling agreement (in principle). Of course, this deal still needs to be ratified by both White House and Republican Congressional leaders before the bill makes its way to US President Bidens desk. US Treasury Secretary Yellen on Friday provided a new date for a potential default providing policymakers with a little more wiggle room as the date was shifted from June 1 to June 5.

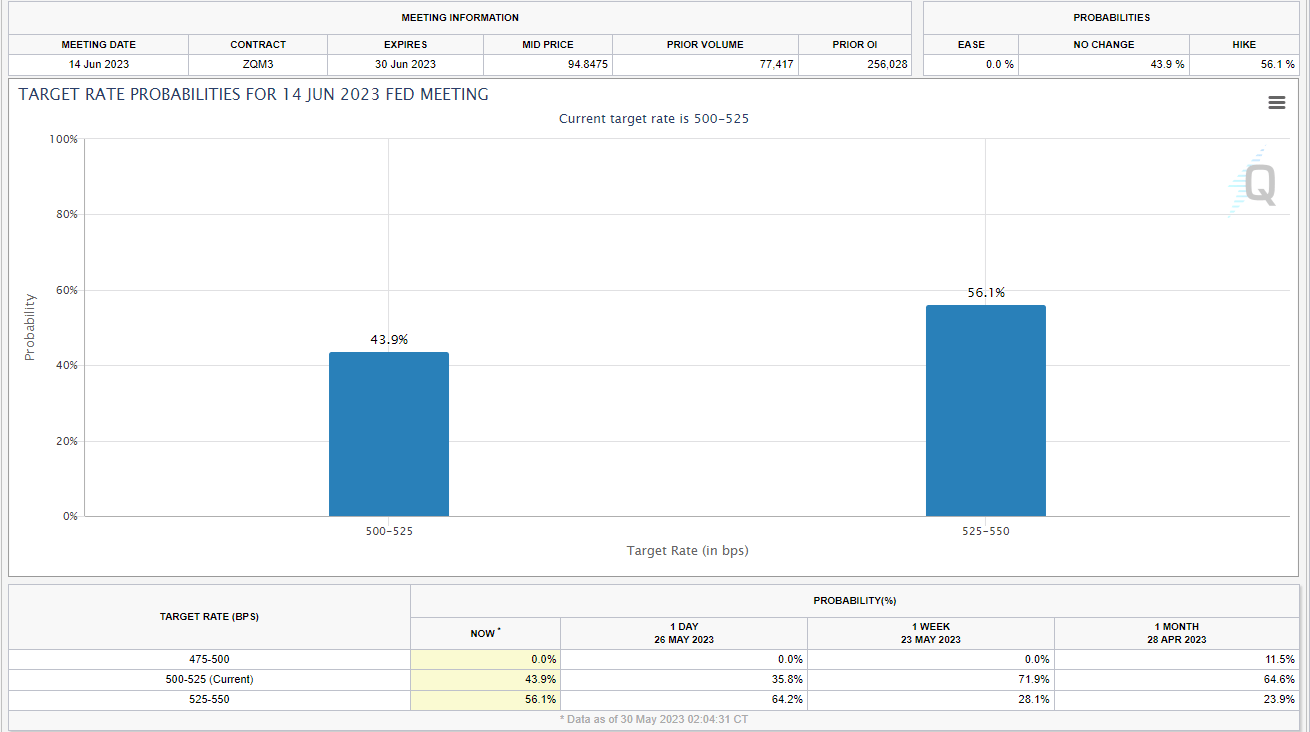

A lot could potentially go wrong in the interim, however more importantly will be the reaction from markets today, which could provide a gauge of what to expect ahead of US jobs data on Friday. The US dollar has also received renewed support of late as Fed Fund rate hike probabilities for the Feds June meeting has increased. Markets are now pricing in around a 56% chance of a 25bps hike in June, up from 28% a week ago. US NFP and jobs data lie ahead this week and could result in an increase in rate hike probabilities should the labor market continue its resilient trend.

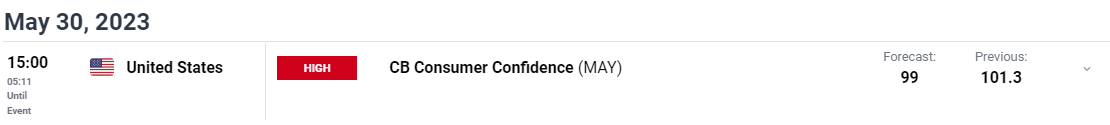

There is not a lot on the docket today with overall sentiment expected to continue driving market movements. The highlight on the economic calendar comes in the form of CB Consumer Confidence data out of the US.

GOLD TECHNICAL OUTLOOK AND FINAL THOUGHTS

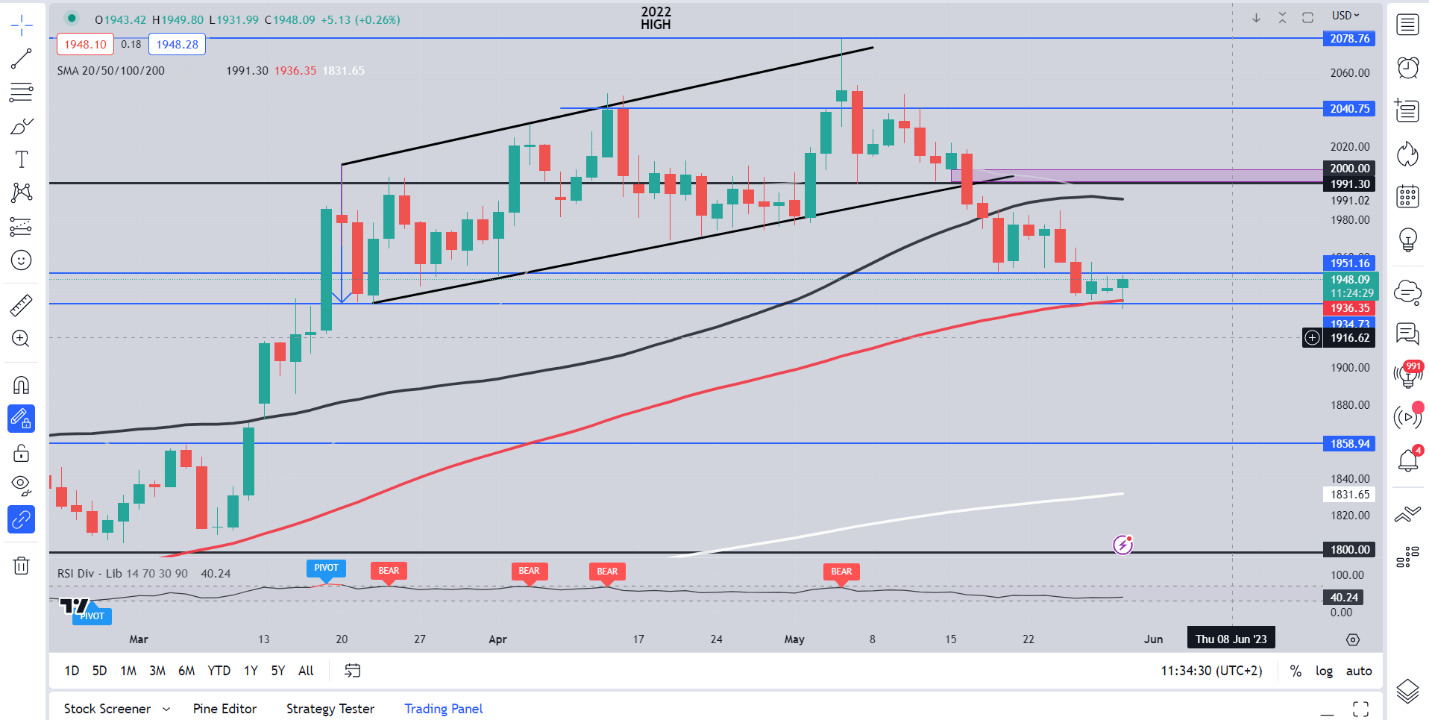

Form a technical perspective, Gold price action had been hinting at further downside for a while as improving sentiment and a strong dollar formed the perfect mix. Yesterday’s daily candle however closed as an inverted hammer hinting at a potential shift and bounce to the upside today.

Following a dip in the Asian session the European session has seen the Dollar Index (DXY) retreat slightly with XAUUSD bouncing off the 100-day MA to trade at $1945/oz at the time of writing. A continuation of the bounce this morning will have the $1950 level to contend with before eyeing resistance around $1957 and $1970 respectively. The 50-day MA currently rests around the $1991 handle should bulls take control and the rally gather steam.

Alternatively, a break back below the 100-day MA around the $1936 mark could see price revisit the $1925 handle before ticking lower toward the psychological $1900 mark. Gold is interesting given a debt ceiling deal could see safe haven demand dissipate, weighing on the precious metal. A weaker dollar on the other hand could support further upside as bulls and bears are likely to continue jostling for position.

Key Intraday Levels to Keep an Eye On

Support Levels:

- 1936 (100-day MA)

- 1925

- 1900

Resistance Levels:

- 1958

- 1970

- 1991 (50-day MA)

Gold (XAU/USD) Daily Chart – May 30, 2023