In the world of gold investing, the term “spot value” holds significant importance. It refers to the current market price of gold for immediate delivery and is a key reference point for trading and valuation purposes. Understanding the concept of spot value is crucial for investors as it serves as a foundation for assessing the worth of gold in various forms. In this article, we will explore the intricacies of spot value, its determinants, and its role in the global gold market.

Defining Spot Value:

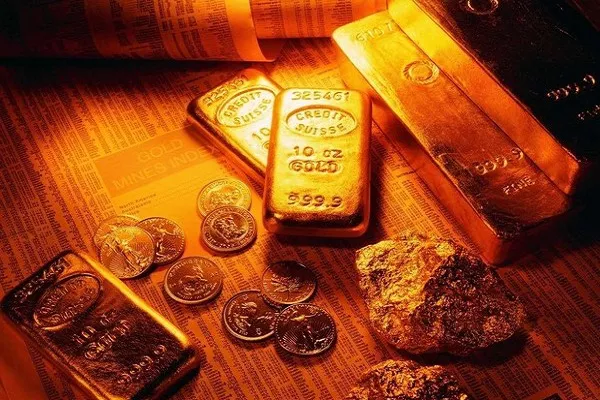

The spot value of gold represents the prevailing market price at which gold trades on the spot market. The spot market, also known as the cash market or physical market, facilitates transactions for immediate settlement and delivery of the precious metal. The spot value is typically expressed per troy ounce and serves as a benchmark for pricing gold-related financial instruments, such as futures contracts, exchange-traded funds (ETFs), and physical gold products.

Factors Influencing Spot Value:

a) Global Supply and Demand Dynamics:

The fundamental forces of supply and demand greatly impact the spot value of gold. Fluctuations in gold production, changes in central bank reserves, shifts in jewelry and industrial demand, and investor sentiment all contribute to the ebb and flow of supply and demand dynamics. A surplus of supply relative to demand may put downward pressure on the spot value, while a deficit can drive prices higher.

b) Economic Conditions and Market Sentiment:

Economic indicators and market sentiment play a pivotal role in shaping the spot value of gold. During times of economic uncertainty, geopolitical tensions, or inflationary concerns, investors often seek refuge in gold as a safe-haven asset. This increased demand can exert upward pressure on the spot value. Conversely, periods of economic stability or positive market sentiment may dampen demand and impact the spot value accordingly.

c) Currency Fluctuations:

Gold is priced in U.S. dollars on the international market, making it susceptible to currency fluctuations. When the U.S. dollar weakens against other major currencies, gold generally becomes more affordable in those currencies, potentially stimulating demand and boosting the spot value. Conversely, a strengthening U.S. dollar may lead to a decrease in the spot value as gold becomes relatively more expensive for buyers using other currencies.

Spot Value vs. Future Prices:

It’s essential to differentiate between spot value and future prices. While spot value reflects the immediate market price, future prices indicate the expected value of gold at a specified future date. Future prices take into account factors such as time, interest rates, storage costs, and market expectations. Unlike spot value, which represents the present market conditions, future prices are subject to speculative considerations and can deviate from spot value due to various factors.

Spot Value and Gold Products:

a) Physical Gold:

For investors looking to purchase physical gold, the spot value serves as a baseline reference for determining the intrinsic value of the metal. Dealers typically charge a premium above the spot value to cover manufacturing costs, operational expenses, and profit margins. The premium varies depending on factors like the form of gold (coins, bars, or jewelry), brand reputation, and market conditions.

b) Derivatives and Futures Contracts:

Financial instruments tied to gold, such as futures contracts and derivatives, derive their pricing from the spot value. These instruments enable investors to speculate on the future movements in gold prices without taking physical possession of the metal. The spot value acts as a benchmark for these derivative contracts, allowing traders to anticipate potential price fluctuations.

Global Market Influences:

The spot value of gold is influenced by international factors and not limited to any particular country or region. The global gold market encompasses a network of participants including miners, refiners, central banks, jewelry manufacturers, institutional investors, and individual traders. Market dynamics, economic indicators, and geopolitical events from around the world collectively shape the spot value of gold.

Conclusion:

The spot value of gold represents the current market price of the precious metal for immediate delivery. It serves as a benchmark for pricing various gold-related financial instruments and acts as a reference point for valuing physical gold products. Determined by global supply and demand dynamics, economic conditions, market sentiment, and currency fluctuations, the spot value is a dynamic indicator that reflects the ongoing interactions in the global gold market. Understanding the concept of spot value empowers investors to make informed decisions, assess the worth of their gold holdings, and navigate the complexities of the gold market with confidence.