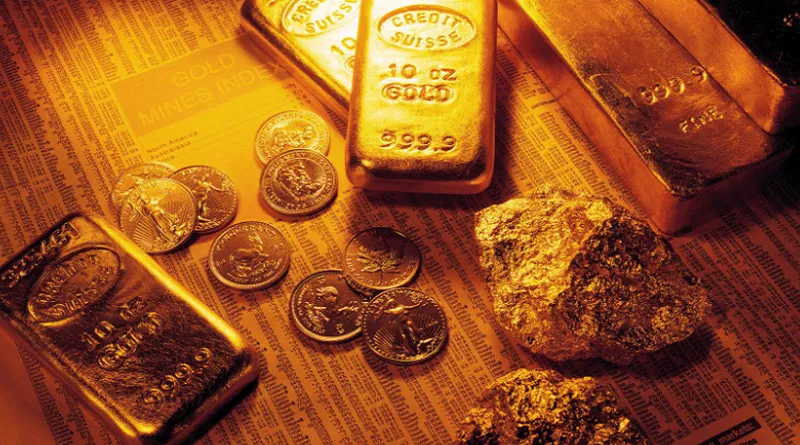

Inflation and gold are two economic factors that have long been intertwined. As inflation erodes the purchasing power of fiat currencies, investors often turn to gold as a safe-haven asset to protect their wealth. In this article, we will delve into the relationship between inflation and the price of gold, exploring the historical context, economic theories, and real-world examples to understand whether inflation indeed makes gold go up. By the end of this analysis, readers will have a comprehensive understanding of the dynamics at play and how inflation influences the demand and value of gold.

The Inflation-Gold Connection Throughout History

The historical connection between inflation and gold can be traced back centuries. Gold has served as a store of value since ancient times, with civilizations using it as a medium of exchange and a form of wealth preservation. In times of economic uncertainty or currency devaluation, individuals and governments alike have turned to gold as a safe asset to safeguard their finances.

Throughout the 20th century, the link between inflation and gold became even more evident. Periods of high inflation, such as the 1970s, saw a surge in the price of gold as investors sought a hedge against rising consumer prices. The inflationary pressures during this era were fueled by factors like oil price shocks and expansive monetary policies, leading to increased demand for gold as a store of value.

Economic Theories on the Inflation-Gold Relationship

Several economic theories offer insights into the relationship between inflation and the price of gold. One prominent theory is the Quantity Theory of Money, which posits that an increase in the money supply leads to a corresponding rise in prices. As inflationary pressures build, the value of fiat currencies diminishes, prompting investors to seek refuge in gold as a tangible and stable asset.

The Expectations Theory is another key economic framework to consider. It suggests that the future price of gold is influenced by investors’ expectations of future inflation. If investors anticipate higher inflation rates, they may increase their demand for gold as a hedge, thus driving up its price.

The Role of Gold as a Hedge Against Inflation

Gold’s reputation as a hedge against inflation is supported by its intrinsic qualities. Unlike fiat currencies, gold has limited supply, making it less susceptible to inflationary pressures. As central banks increase money supply to combat economic challenges, the scarcity of gold reinforces its appeal as a safe-haven asset that preserves purchasing power.

During times of economic uncertainty or inflationary pressures, investors often allocate a portion of their portfolios to gold as a means of diversification and risk management. The historical performance of gold during periods of inflation underscores its ability to retain value and act as a buffer against economic fluctuations.

Real-World Examples of Inflation and Gold Prices

Examining real-world examples helps to solidify the relationship between inflation and gold prices. For instance, during the inflationary period of the 1970s, the price of gold surged significantly. In 1971, when the United States abandoned the gold standard, gold prices skyrocketed, reaching an all-time high in 1980.

Similarly, during the global financial crisis of 2008 and the subsequent era of quantitative easing, gold experienced a remarkable rally. As concerns over currency debasement and economic instability grew, investors flocked to gold, pushing its price to new highs.

Factors Influencing the Inflation-Gold Relationship

While the link between inflation and gold prices is well-established, other factors also influence the relationship. Geopolitical tensions, economic growth prospects, interest rates, and market sentiment can impact the demand for gold independently of inflation.

In times of geopolitical uncertainty, gold often sees increased demand as investors seek a safe haven amid global turbulence. Similarly, expectations of economic growth or contraction can affect investor sentiment towards gold. In times of economic prosperity, the demand for gold as a hedge against inflation may wane, while economic downturns may lead to increased gold demand.

Risks and Considerations in Investing in Gold as a Hedge

While gold has historically demonstrated its resilience as a hedge against inflation, investing in the precious metal also carries risks and considerations. Gold prices can be volatile, subject to sudden market shifts and sentiment-driven fluctuations. Moreover, while gold may act as a hedge in times of inflation, it may not necessarily outperform other assets in all economic scenarios.

Investors should carefully evaluate their financial goals, risk tolerance, and time horizon before incorporating gold into their investment portfolio. Diversification remains a key principle in investment strategy, and gold should be viewed as a complementary component rather than a sole solution.

Conclusion:

The relationship between inflation and the price of gold is a complex interplay of economic theories, historical contexts, and real-world examples. While gold has proven to be a reliable hedge against inflation, other factors also influence its price and demand.

Investors considering gold as a hedge should carefully assess their financial objectives and consult with financial advisors to determine the appropriate allocation in their investment portfolio. By understanding the dynamics of inflation and the role of gold as a safe-haven asset, investors can make informed decisions to protect and preserve their wealth in an ever-changing economic landscape.