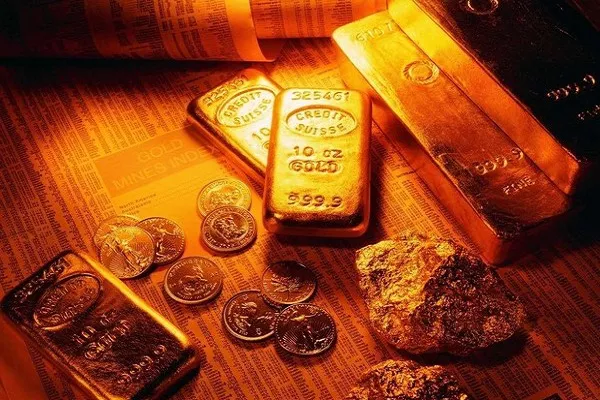

Gold has long been revered as a valuable asset, appreciated for its enduring allure and stability. Whether inherited, acquired as an investment, or accumulated over time, individuals often find themselves asking, “Can I sell my gold?” While the answer is unequivocally yes, navigating the process requires understanding key considerations, market dynamics, and potential benefits. This article aims to provide a comprehensive guide to selling gold, empowering individuals to make informed decisions about their precious metal holdings.

Understanding the Decision to Sell

Deciding to sell gold can be prompted by various reasons, ranging from financial needs to strategic portfolio management. Individuals may choose to sell their gold to capitalize on market highs, rebalance their investment portfolio, or generate liquidity during times of economic uncertainty. It’s essential to clarify your motives for selling to ensure that your decision aligns with your financial goals and circumstances.

Exploring the Market

Before embarking on the selling process, it’s crucial to have a solid understanding of the gold market. Gold prices are influenced by a complex interplay of factors, including global economic conditions, geopolitical events, inflation, and currency fluctuations. Tracking gold prices over time and staying informed about market trends can help you identify favorable selling opportunities.

Assessing the Value of Your Gold

To determine the value of your gold, you must first assess its purity and weight. The purity of gold is measured in karats, with 24-karat gold being the purest form. The weight of gold is typically measured in troy ounces. Various online resources, including reputable gold dealers and market platforms, offer real-time price information to help you gauge the current value of your gold.

Considering Selling Channels

When selling gold, you have several options to consider:

Local Jewelers and Pawnshops: Local jewelers and pawnshops may offer convenience but might not provide the best value for your gold due to lower payouts and limited market insights.

Online Platforms: Online platforms and marketplaces provide access to a broader pool of potential buyers, potentially leading to competitive offers. Ensure that the platform is reputable and has favorable user reviews.

Gold Dealers and Refiners: Gold dealers and refiners specialize in buying gold and may offer competitive prices. They often assess the purity and weight of your gold accurately, leading to fair valuations.

Auction Houses: For rare or collectible gold items, auction houses can be a viable option. Auctions can attract a niche audience willing to pay a premium for unique pieces.

Gold Exchange-Traded Funds (ETFs): If you hold gold in the form of ETFs, selling shares of these funds can be a convenient way to liquidate your gold holdings.

Navigating the Selling Process

Once you’ve chosen a selling channel, it’s important to follow a systematic process:

Research: Gather information about the buyer, their reputation, and their history of transactions. Verify their credentials and read reviews from previous sellers.

Get Multiple Offers: If possible, obtain multiple offers for your gold. This will allow you to compare prices and ensure you’re receiving a fair deal.

Negotiation: Don’t hesitate to negotiate the offered price. Polite negotiation can sometimes lead to a better deal, especially if you have multiple offers to leverage.

Documentation: Keep detailed records of your interactions with potential buyers, including offers, negotiations, and any agreements reached.

Secure Shipping and Payment: If selling online, ensure that the shipping process is secure and insured. Choose a payment method that offers the highest level of security.

Review the Terms: Before finalizing any sale, review the terms and conditions carefully to avoid any surprises or misunderstandings.

Tax Implications

Selling gold can have tax implications, depending on your jurisdiction and the nature of the transaction. In some cases, profits from selling gold may be subject to capital gains tax. It’s advisable to consult with a tax professional or financial advisor to understand the tax implications specific to your situation.

Benefits of Selling Gold

Selling gold can offer several benefits, including:

Liquidity: Gold can be converted into cash relatively quickly, providing liquidity during financial emergencies.

Diversification: Selling gold can help you rebalance your investment portfolio and diversify your holdings.

Capitalizing on Highs: Selling during periods of high gold prices can result in favorable returns on your investment.

Financial Flexibility: Selling gold allows you to access funds for various purposes, such as purchasing a home, funding education, or traveling.

Conclusion

In conclusion, the question “Can I sell my gold?” is met with a resounding yes. However, selling gold is a decision that should be approached thoughtfully and strategically. Understanding the gold market, evaluating your reasons for selling, and carefully selecting a selling channel are essential steps in the process. By following a systematic approach, considering tax implications, and being aware of the potential benefits, individuals can confidently navigate the journey of selling their gold assets. As with any financial decision, seeking guidance from financial professionals can provide valuable insights tailored to your unique circumstances.