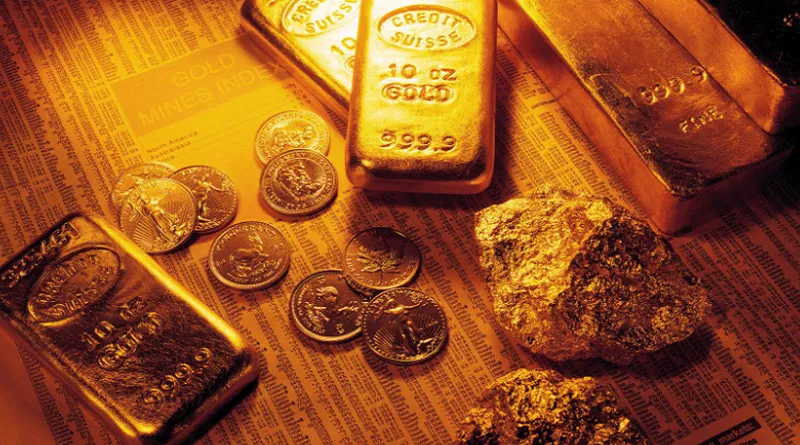

Investing in precious metals, particularly gold, has long been considered a safe-haven strategy for diversifying one’s portfolio and preserving wealth. The “spot price” of gold refers to the current market value of the metal at any given moment. However, the question remains: Can you actually buy gold at the spot price? In this article, we will delve into the nuances of purchasing gold at or near the spot price and explore the factors that influence this process.

Understanding Spot Price

Before delving into the intricacies of buying gold at spot price, it’s essential to grasp the concept of spot price itself. The spot price is the prevailing market price for an immediate transaction, where the commodity is bought or sold for immediate delivery. It serves as a benchmark for investors and traders, providing a real-time indication of the value of gold. While it’s used as a reference point, the actual purchase price of gold can differ due to various factors.

Factors Influencing Purchase Price

Dealer Premiums:

When buying physical gold, investors often encounter dealer premiums. These are costs added to the spot price by dealers to cover their expenses and profit margins. Dealer premiums can vary significantly based on factors such as the form of gold (coins, bars, etc.) and the dealer’s reputation. Thus, while the spot price reflects the intrinsic value of gold, the actual purchase price will include these additional costs.

Type of Gold:

The form in which you choose to buy gold can impact the purchase price. Gold coins, for instance, often carry higher premiums than gold bars due to factors like craftsmanship, historical significance, and collectibility.

Market Demand and Supply:

Like any other commodity, gold prices are influenced by supply and demand dynamics. In times of high demand and limited supply, the purchase price might exceed the spot price. Economic conditions, geopolitical events, and investor sentiment all contribute to these fluctuations.

Market Conditions:

Market conditions at the time of purchase play a crucial role. Volatile market situations can lead to larger disparities between the spot price and the actual purchase price.

Bullion vs. Numismatic Coins:

Bullion coins are valued primarily for their precious metal content, closely reflecting the spot price. Numismatic coins, on the other hand, carry additional value due to their rarity, historical significance, and condition. As a result, purchasing numismatic coins often involves paying a higher premium over the spot price.

Buying Gold at or Near Spot Price

While it’s rare to buy physical gold at the exact spot price, there are ways to come close to it:

Large Purchases: Institutional investors and high-net-worth individuals who buy gold in larger quantities might have the negotiating power to secure prices very close to the spot price.

Online Dealers: Online precious metals dealers have streamlined operations and lower overhead costs compared to brick-and-mortar stores. This allows them to offer gold at relatively lower premiums, thereby reducing the gap between the spot price and the purchase price.

Secondary Market: Purchasing gold from the secondary market, such as from other investors or collectors, can sometimes lead to prices closer to the spot price. However, the availability of products might be limited, and buyers should exercise caution to ensure the authenticity of the gold.

Promotional Offers: Dealers occasionally run promotions, offering gold at reduced premiums or with waived fees. These limited-time offers can provide opportunities to acquire gold at prices more favorable than usual.

Tips for Buying Gold

Research: Thoroughly research the dealer’s reputation and pricing structure before making a purchase. Online reviews, ratings, and customer feedback can provide valuable insights.

Compare Quotes: Obtain quotes from multiple dealers to compare premiums and find the best deal. Remember that the lowest price might not always be the best option if the dealer’s credibility is questionable.

Consider Larger Quantities: Buying larger quantities of gold can provide better negotiating power and potentially reduce premiums.

Understand Premiums: Understand that premiums are a standard part of purchasing physical gold. Compare the premiums of different forms (coins, bars) and choose what aligns with your goals.

Timing: While market timing can be challenging, being aware of market trends can help you make more informed decisions.

Conclusion

While buying gold at the exact spot price might be a rarity, investors can certainly come close to it by considering various strategies and factors. Dealer premiums, market conditions, and the type of gold being purchased all influence the final purchase price. In the end, a thorough understanding of these dynamics, combined with diligent research and prudent decision-making,can help investors make the most of their gold purchases while striving to minimize the gap between the spot price and the actual purchase price.