As of August 30, gold prices have maintained their buoyancy near their highest levels in three weeks, bolstered by underwhelming U.S. jobs openings and consumer confidence data that have tempered expectations of imminent interest rate hikes by the Federal Reserve.

Key Points:

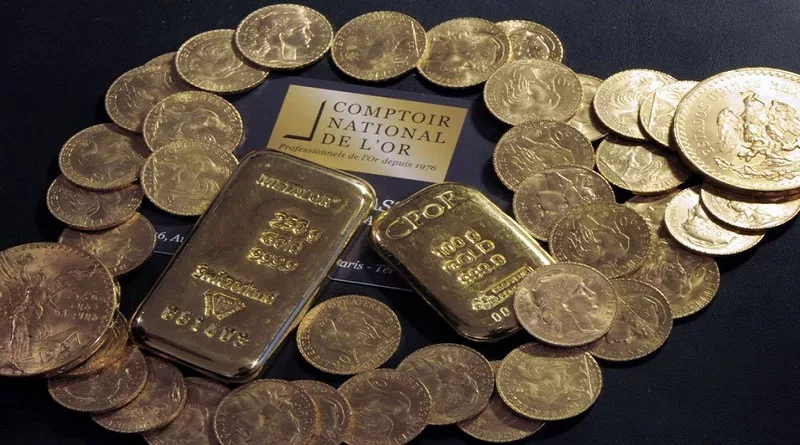

Spot gold has remained resilient, trading at $1,936.59 per ounce by 0115 GMT, in proximity to its highest levels since August 7, a peak reached on the preceding Tuesday. Meanwhile, U.S. gold futures have stabilized at $1,964.30.

The dip in U.S. Treasury yields to three-week lows on Tuesday following the release of lackluster data and the resultant weakening of the dollar have made gold more affordable for holders of other currencies. With lower rates enhancing the appeal of non-interest-bearing assets like gold, the metal’s demand has been favorably impacted.

The U.S. experienced a decline in job openings, reaching the lowest level in nearly 2.5 years in July, as the labor market’s growth rate decelerated. This development has reinforced expectations of the Federal Reserve maintaining status quo on interest rates in the upcoming month.

In August, U.S. consumer confidence saw a greater-than-anticipated drop after consecutive monthly gains. These figures were attributed to renewed concerns about inflation, according to a recent survey.

Investor focus now shifts to the Commerce Department’s revised estimate for April-June GDP, which is anticipated to be released later on the same day. Subsequent highlights include the personal consumption expenditures price index on Thursday and the eagerly awaited non-farm payrolls report on Friday.

Former central bankers have opined that, unless faced with pronounced economic frailty or disinflation, the U.S. Federal Reserve is unlikely to convey clear indications about whether it will halt interest rate hikes or consider rate cuts.

SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, reported an uptick of 0.3% in its holdings to 889.23 metric tons on Tuesday.

In the realm of other precious metals, spot silver has experienced a 0.2% decline, settling at $24.68 per ounce, yet remaining proximate to its one-month peak.

Platinum has moderately retreated by 0.1% to $975.14, having reached its highest point since July 19 in the preceding session. Concurrently, palladium witnessed a marginal dip of 0.3% to $1,245.44.

As the market awaits upcoming data releases and closely observes the Federal Reserve’s approach, gold’s stability amid economic uncertainties continues to capture the attention of investors.