Investors Seek Clarity on U.S. Economy Ahead of Federal Reserve Meeting

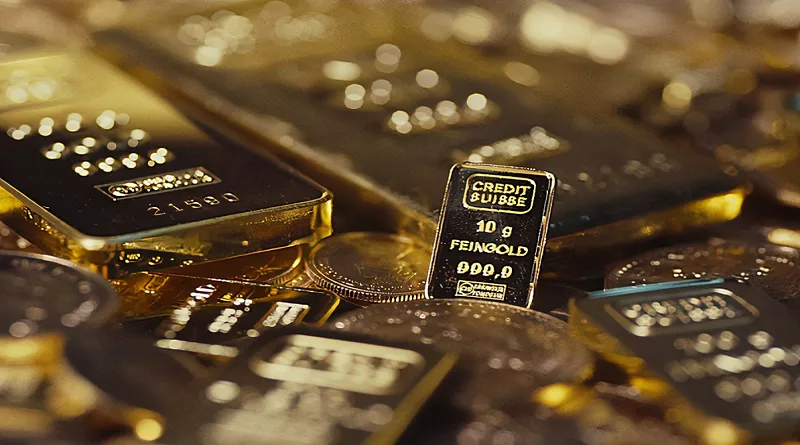

Gold prices remained relatively steady on Tuesday as investors awaited further insights into the state of the U.S. economy ahead of the upcoming Federal Reserve meeting. Expectations for a pause in interest rate hikes have been rising.

At 0058 GMT, spot gold displayed minimal movement, trading at $1,937.58 per ounce, slightly below the one-month highs reached on Friday. Meanwhile, U.S. gold futures experienced a slight decline of 0.2%, settling at $1,963.40 per ounce. Trading activity was subdued on Monday due to a holiday in the United States.

The U.S. dollar index showed a modest drop of 0.1% against its peers.

Investor sentiment in the euro zone faced a larger decline than anticipated at the beginning of September, with Germany’s economic weaknesses continuing to weigh on the region, according to a survey released on Monday.

Central banks in both major developed and emerging economies took a pause in August, with the pace and scale of interest rate hikes moderating further. Diverging growth outlooks and inflation concerns complicated the outlook for monetary policy.

Former Bank of Japan (BOJ) board member Goushi Kataoka stated on Monday that the BOJ would only gradually transition away from its accommodative monetary policy once its 2% inflation target had been sustainably achieved.

Shares of developer Country Garden rose on Monday after the company reached an agreement with creditors to extend onshore debt payments worth 3.9 billion yuan ($536 million). This development provided some relief to China’s beleaguered property sector.

In other precious metals, spot silver experienced a marginal decline of 0.1%, trading at $23.94 per ounce. Platinum dipped by 0.6%, reaching $948.20 per ounce, while palladium remained unchanged at $1,221.45 per ounce.