Investing in gold has been a time-tested strategy for wealth preservation and portfolio diversification. As the allure of this precious metal continues to attract investors, it becomes crucial to understand the best ways to buy gold. Whether you are a seasoned investor or a newcomer to the world of precious metals, this comprehensive guide will explore various avenues for acquiring gold and offer insights into the best practices to make informed decisions.

Understanding the Forms of Gold

Gold is available in various forms, each catering to different investor preferences and goals. The primary forms include physical gold, gold ETFs (Exchange-Traded Funds), gold mining stocks, and gold futures. The best way to buy gold depends on your investment objectives, risk tolerance, and the level of involvement you seek.

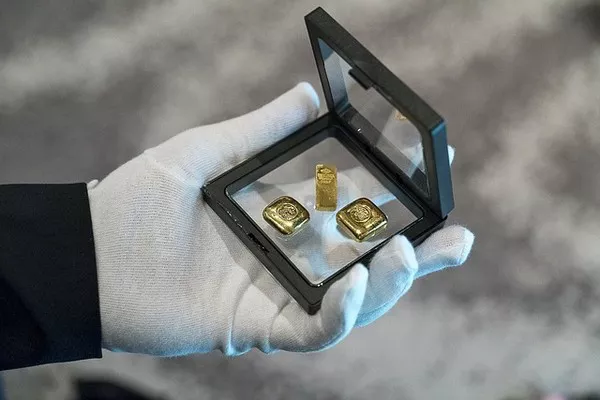

Physical gold, such as gold bars and coins, provides tangible ownership and is a popular choice for those who prefer holding a physical asset. However, storing and insuring physical gold can be challenging.

Gold ETFs offer a convenient way to invest in gold without the burden of physical storage. These funds track the price of gold and are traded on stock exchanges, providing liquidity and ease of buying and selling.

Gold mining stocks represent shares in companies involved in gold exploration and production. While these stocks are influenced by factors beyond gold prices, they offer exposure to the potential profits of successful mining operations.

Gold futures involve contracts to buy or sell gold at a predetermined price at a future date. This method is more complex and suitable for experienced investors due to the associated risks.

Researching Reputable Dealers

When opting for physical gold, choosing a reputable dealer is paramount. Research and select dealers with a proven track record of integrity, reliability, and transparent pricing. Look for dealers who are members of industry associations and have positive reviews from customers.

Online platforms have become popular channels for buying gold. Before making a purchase, verify the security measures implemented by the platform, such as encryption and secure payment gateways. Additionally, check for customer support availability and responsiveness.

Local coin shops and established dealers with a physical presence offer the advantage of in-person transactions. Visit their locations, ask questions, and inspect the gold products before making a purchase. A reliable dealer will provide certificates of authenticity and disclose any relevant information about the gold’s origin and purity.

Determining Gold Purity and Authenticity

Understanding the purity of gold is crucial when buying physical gold. Gold purity is measured in karats, with 24 karats being pure gold. Common purities include 22 karats (91.7% gold) and 18 karats (75% gold). Verify the purity of gold products through hallmarking, a process where an official stamp certifies the authenticity and purity of the gold.

Investors should also be cautious about counterfeit gold products. Counterfeiters often mimic popular gold coins and bars. Use reputable dealers, request certificates of authenticity, and perform additional tests such as specific gravity or the use of a gold testing kit to verify the legitimacy of the gold.

See Also: What Is The Price Of An Ounce Of Gold

Diversifying with Gold ETFs

Gold ETFs offer a practical and liquid alternative for investors seeking exposure to gold prices without the challenges of physical ownership. When considering gold ETFs, research the fund’s performance, expense ratio, and the method used to track gold prices.

Examine the fund’s historical performance and compare it to the benchmark it tracks. A lower expense ratio is generally preferable, as it minimizes the impact of fees on your returns over time. Understand whether the ETF holds physical gold or uses other financial instruments to replicate gold price movements.

Assessing Risk Tolerance and Investment Horizon

Gold prices can be volatile, and market conditions may vary. Assess your risk tolerance and investment horizon before deciding on the best way to buy gold. Physical gold ownership may suit long-term investors seeking wealth preservation, while ETFs or gold mining stocks may be more suitable for those with a higher risk tolerance and a shorter investment horizon.

Consider the role of gold in your overall investment strategy. If you are using gold as a hedge against economic uncertainty, geopolitical risks, or currency fluctuations, factor these considerations into your investment decisions.

Conclusion

Investing in gold requires careful consideration of various factors, including the form of gold, the reputation of dealers, purity, and authenticity. Whether opting for physical gold, gold ETFs, or other investment vehicles, a well-informed approach is essential to navigate the golden path successfully. By conducting thorough research, understanding market dynamics, and aligning your investment strategy with your financial goals, you can make sound decisions that stand the test of time in the dynamic world of gold investing.