Gold has long been regarded as a store of value and a safe-haven asset, making it a popular choice for investors looking to diversify their portfolios. However, not all gold is created equal, and understanding the various forms of gold available in the market is crucial for making informed investment decisions. In this article, we will explore the different types of gold and provide insights into what makes each option unique, helping investors identify the best gold to buy for their specific needs.

Physical Gold:

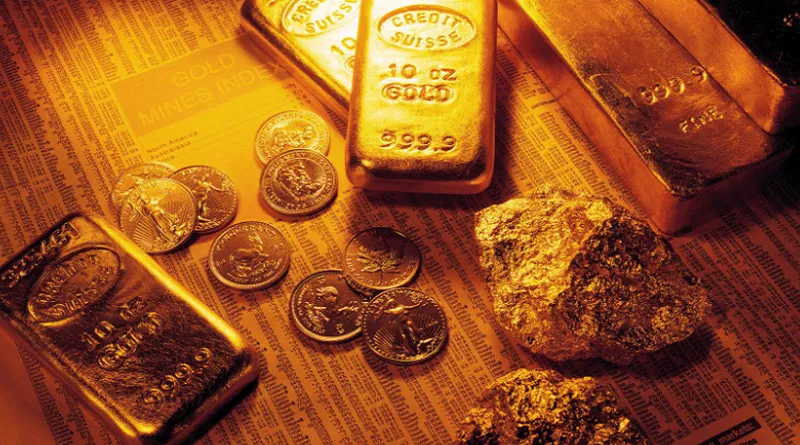

Physical gold comes in various forms, including coins, bars, and jewelry. When considering physical gold for investment, factors such as purity, weight, and craftsmanship play a significant role. Gold coins from reputable mints, such as the American Gold Eagle or the South African Krugerrand, are popular choices due to their recognized quality and liquidity.

Gold bars, often produced by renowned refineries like PAMP Suisse or Valcambi, offer a more cost-effective way to invest in larger quantities of gold. However, potential investors should be aware of the market’s preference for standardized weights, such as one ounce or ten grams, to ensure ease of resale.

Jewelry, while aesthetically pleasing, may not be the ideal form of investment due to additional costs associated with craftsmanship. Additionally, the resale value of jewelry can be subjective, influenced by factors such as design trends and cultural preferences.

Gold ETFs (Exchange-Traded Funds):

For investors seeking exposure to gold without the need for physical possession, Gold ETFs provide a convenient option. These funds are designed to track the price of gold and are traded on stock exchanges, allowing investors to buy and sell shares easily.

One of the key advantages of Gold ETFs is their liquidity and ease of trading. Investors can buy and sell shares throughout the trading day, providing flexibility in responding to market conditions. Additionally, Gold ETFs typically have lower expenses compared to actively managed funds.

However, it’s essential to be mindful of the tracking method employed by the ETF. Some funds hold physical gold, while others use financial instruments like futures contracts. Understanding the underlying assets and the fund’s structure is crucial for making an informed investment decision.

Gold Mining Stocks:

Investing in gold mining stocks provides exposure to the performance of gold prices and the potential for additional returns through the success of the mining company. However, this option comes with its own set of risks and considerations.

The value of gold mining stocks can be influenced by factors beyond gold prices, such as operational efficiency, geopolitical stability, and management competence. Investors should thoroughly research and analyze the financial health and track record of the mining companies in which they plan to invest.

See Also What Is Highest Price Of Gold In History

Numismatic Coins:

Numismatic coins, often rare or collectible coins, are sought after by collectors for their historical or artistic value. While these coins can be a fascinating addition to a collection, they may not be the best choice for pure gold investment.

Numismatic coins often carry a higher premium due to their rarity and unique characteristics. Investors should be cautious, as the value of these coins may fluctuate based on collector demand rather than the intrinsic value of the gold they contain.

Conclusion:

Choosing the best gold for investment requires a careful consideration of one’s financial goals, risk tolerance, and preferences. Physical gold, Gold ETFs, gold mining stocks, and numismatic coins each have their own advantages and drawbacks. Ultimately, the right choice depends on the investor’s objectives, whether it be wealth preservation, capital appreciation, or a combination of both.

Before making any investment decisions, it is advisable to consult with financial advisors and conduct thorough research to ensure a well-informed choice. Regardless of the chosen form of gold investment, staying informed about market trends and economic indicators will help investors navigate the dynamic landscape of the gold market and make sound investment decisions.