In response to subtle fluctuations in the U.S. dollar, gold prices made strides on Tuesday, though gains were tempered by expectations of prolonged higher U.S. interest rates. Concurrently, copper experienced a 1% surge following reports of additional Chinese government measures to bolster local markets.

China, the world’s foremost copper importer, remained a focal point influencing copper prices. Traders closely monitored evolving dynamics in the U.S. economy, recalibrating their outlook as anticipation waned for a Federal Reserve interest rate cut by March 2024. This shift had notably impacted gold prices earlier in January, briefly pushing the precious metal to $2,000 per ounce.

Gold rebounded from its January lows, buoyed by escalating geopolitical tensions in the Middle East, prompting safe-haven demand. Additionally, optimism persisted as traders speculated on potential future monetary policy adjustments by the Federal Reserve.

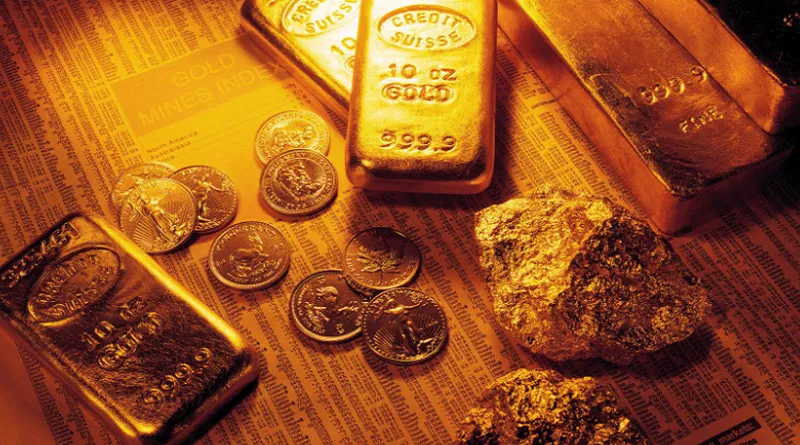

As of 00:34 ET (05:34 GMT), spot gold rose by 0.4% to $2,029.53 per ounce, and gold futures expiring in February increased by 0.4% to $2,030.70 per ounce.

Attention now turns to key U.S. economic data, with a spotlight on fourth-quarter gross domestic product figures scheduled for release this Thursday. Analysts anticipate a moderation in overall growth, but any display of economic resilience could reinforce the Federal Reserve’s ability to maintain higher interest rates. The upcoming Federal Reserve meeting, where rates are widely expected to be held at 23-year highs, adds another layer of anticipation.

Preceding the GDP data, the Personal Consumption Expenditures (PCE) price index, the Fed‘s preferred inflation metric, is set to be unveiled on Friday. Expectations are that it will reaffirm persistent inflation through December.

Concerns over sticky U.S. inflation, coupled with a robust labor market, prompted traders to rethink the likelihood of a March rate cut. Earlier in January, this shift in sentiment led to significant declines in gold prices, given the negative correlation between gold and high interest rates.

Copper futures expiring in March registered nearly a 1% increase, reaching $3.7823, recovering a substantial portion of losses incurred earlier in the year. This uptick in copper prices mirrored a broader upswing in Chinese financial markets, following reports of a potential 2 trillion yuan ($278 billion) support package for mainland stocks. The prospect of continued support for the Chinese economy injected optimism, sustaining copper demand.

Markets had been cautious over the past two years due to the specter of an economic slowdown in China, a significant factor weighing on copper prices. However, the current outlook suggests a potential reversal of this trend, supported by positive sentiments surrounding Chinese economic resilience.