Gold prices held firm just below record highs in Asian trading on Monday, with the focus shifting to upcoming U.S. inflation data for insights into when the Federal Reserve might initiate interest rate cuts.

Expectations of rate cuts propelled bullion prices sharply higher last week, particularly after Fed Chair Jerome Powell indicated that inflation was nearing levels the Fed finds acceptable. Modest labor market data, signaling a slowdown in U.S. employment, also contributed to the rise in gold prices. Additionally, weakness in the dollar and Treasury yields supported the precious metal.

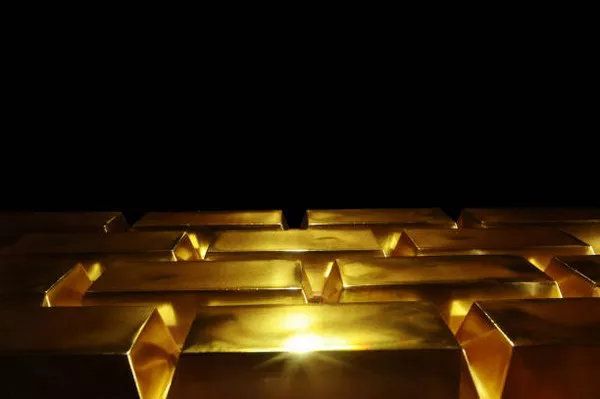

Spot gold edged up 0.1% to $2,180.47 per ounce, while gold futures expiring in April increased by 0.1% to $2,187.00 per ounce by 00:50 ET (04:50 GMT), both trading just below the record highs reached on Friday.

Gold futures hit an all-time high of $2,203.0 per ounce, while spot gold touched a record high of $2,195.20 per ounce last week.

Investor attention is now focused on the U.S. Consumer Price Index (CPI) data scheduled for release on Tuesday, seeking further clues about the direction of interest rates. The CPI reading is expected to show a moderation in inflation for February, although it is anticipated to remain well above the Fed’s 2% annual target.

U.S. inflation is a key point of interest this week, particularly following comments from Powell and other Fed officials, highlighting concerns about persistent inflation as the central bank’s primary consideration for potential interest rate cuts.

The prospect of lower interest rates has been a significant driver of gold prices over the past two weeks, especially given the labor market data released on Friday, which showed a slowdown in employment growth. While nonfarm payrolls exceeded expectations in February, the rise in unemployment and substantial downward revisions to January’s payroll readings underscored some cooling in the employment sector.

Other precious metals experienced muted movements on Monday but maintained strong gains from the previous week. Platinum futures rose 0.2% to $919.40 per ounce, while silver futures dipped 0.1% to $24.517 per ounce.