In Asian trade on Monday, gold prices experienced a decline, relinquishing a crucial support level as traders exhibited aversion towards non-yielding assets ahead of the upcoming Federal Reserve meeting later in the week.

Simultaneously, the rally in industrial metals seemed to have paused, with copper prices easing after reaching 11-month highs last week. Profit-taking in the red metal was prompted by moderate Chinese economic data.

The losses observed in precious metals were particularly pronounced, as the dollar stabilized near two-week highs in anticipation of the Federal Reserve meeting. Additionally, 10-year Treasury yields remained comfortably above 4%.

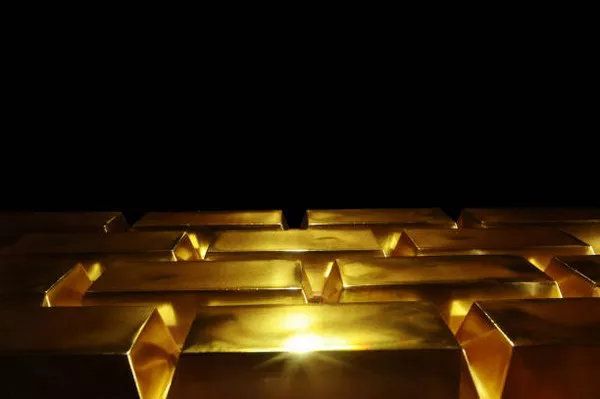

Spot gold recorded a 0.4% decline, reaching $2,148.19 an ounce, while gold futures expiring in April slid by 0.5% to $2,151.05 an ounce as of 00:20 ET (04:20 GMT).

All eyes are now on the conclusion of the two-day Federal Reserve meeting scheduled for Wednesday, where it is widely anticipated that the central bank will maintain interest rates at their current level. However, any indications regarding potential interest rate cuts will be closely scrutinized, particularly following hotter-than-expected inflation readings for February, which have raised concerns about hawkish signals from the central bank.

This sentiment has notably pulled gold prices back from the record highs reached earlier in March, with the drop below the $2,150 support level potentially signaling further losses in the near-term.

Analysts at ANZ noted in a recent report that gold prices could potentially decline to as low as $2,100 an ounce in the near-term. However, they also upgraded their end-2024 price target for the yellow metal to $2,300 an ounce, citing the potential for an eventual interest rate cut and deteriorating economic conditions to bolster demand for gold this year.

Furthermore, other precious metals also experienced retreats on Monday, with platinum futures falling by 0.7% to $935.50 an ounce, and silver futures sliding by 0.7% to $25.198 an ounce.