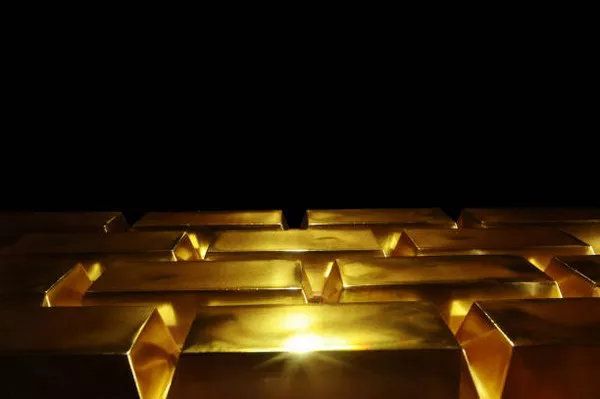

Gold has been revered throughout human history for its intrinsic value, rarity, and enduring appeal. Its status as a symbol of wealth and stability remains unchanged in the modern era. Investors, collectors, and individuals alike often contemplate the worth of gold in various quantities, including smaller denominations like 2.5 grams. In this article, we delve into the factors influencing the value of 2.5 grams of gold, exploring its market dynamics, historical significance, and practical implications.

The Market Value of Gold:

Before delving into the specific value of 2.5 grams of gold, it’s essential to understand the broader market dynamics that govern the price of this precious metal. Gold is traded globally on commodities exchanges, with prices fluctuating based on supply and demand dynamics, economic indicators, geopolitical events, and investor sentiment.

The price of gold is typically quoted per troy ounce, with one troy ounce equaling approximately 31.1 grams. Therefore, the value of 2.5 grams of gold is derived from the current market price per troy ounce. Factors influencing gold prices include:

Supply and Demand: Like any commodity, the price of gold is influenced by the balance between supply and demand. Changes in mining output, central bank reserves, jewelry demand, and investment demand can impact the supply-demand dynamics of gold.

Inflation and Economic Uncertainty: Gold is often viewed as a hedge against inflation and economic uncertainty. During times of economic turmoil or when inflationary pressures are high, investors tend to flock to gold as a safe haven asset, driving up its price.

Currency Movements: Since gold is traded globally, its price is influenced by fluctuations in currency exchange rates. A weaker dollar, for example, often leads to higher gold prices, as it becomes cheaper for investors holding other currencies to purchase gold.

Geopolitical Events: Geopolitical tensions, conflicts, and global events can impact investor sentiment and drive up demand for gold as a perceived safe asset, leading to an increase in its price.

Interest Rates: Gold doesn’t provide a yield or interest like bonds or savings accounts. Therefore, changes in interest rates can affect the opportunity cost of holding gold. When interest rates are low, the opportunity cost of holding gold decreases, making it more attractive to investors.

Calculating the Value of 2.5 Grams of Gold:

To determine the value of 2.5 grams of gold, we need to consider the current market price per troy ounce and perform a simple calculation. As of [current date], the price of gold per troy ounce is [insert current price]. Using this information, we can calculate the value of 2.5 grams of gold as follows:

Value of 2.5 grams of gold=(Price per troy ounce/31.1)×2.5

This formula divides the current price per troy ounce by 31.1 (the number of grams per troy ounce) to determine the price per gram of gold. Multiplying this value by 2.5 gives us the total value of 2.5 grams of gold.

Historical Significance of Gold:

Gold’s allure extends far beyond its monetary value. Throughout history, gold has been prized for its cultural, religious, and symbolic significance. Ancient civilizations revered gold as a symbol of wealth, power, and divinity. It adorned the tombs of pharaohs in ancient Egypt, adorned the crowns of kings and queens, and served as the basis for monetary systems around the world.

In addition to its cultural significance, gold has played a crucial role in shaping economies and societies. The Gold Standard, which pegged the value of currencies to gold, was adopted by many countries in the 19th and early 20th centuries. While the Gold Standard has largely been abandoned in favor of fiat currencies, gold continues to hold a prominent place in the global economy and financial markets.

Practical Implications of Owning 2.5 Grams of Gold:

While 2.5 grams of gold may seem like a small quantity, it holds practical significance for individuals seeking to diversify their investment portfolios, hedge against inflation, or preserve wealth. Here are some practical implications of owning 2.5 grams of gold:

Portfolio Diversification: Gold is often recommended as a diversification tool within investment portfolios. Its low correlation with other asset classes, such as stocks and bonds, can help reduce overall portfolio risk.

Inflation Hedge: Gold has historically served as an effective hedge against inflation. By holding gold, investors can preserve the purchasing power of their wealth in periods of rising prices.

Wealth Preservation: In times of economic uncertainty or market volatility, gold can serve as a store of value. Unlike paper currencies, which can be devalued by central banks or governments, gold maintains its intrinsic value over time.

Liquidity: Gold ishighly liquid, meaning it can be easily bought, sold, and traded in global markets. This liquidity ensures that investors can convert their gold holdings into cash relatively quickly when needed.

See Also How Much Is A Pure Gold Coin Worth? A Comprehensive Guide

Conclusion:

In conclusion, the value of 2.5 grams of gold is determined by a variety of factors, including the current market price of gold, supply and demand dynamics, economic conditions, and geopolitical events. While 2.5 grams may seem like a small quantity, gold holds significant cultural, historical, and practical significance. Whether viewed as an investment, a hedge against inflation, or a store of value, gold continues to captivate the imagination and play a vital role in the global economy. Understanding the factors influencing the value of gold can help investors make informed decisions about incorporating this precious metal into their portfolios.