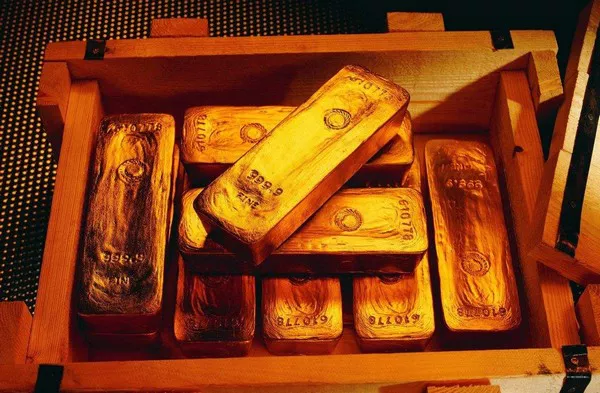

Gold, with its primal allure, has captured the world’s attention as it surged to record prices of $2,400 per troy ounce this year. Beyond the confines of supply and demand analyses, the yellow metal’s shine reflects today’s charged geopolitical landscape, characterized by war-driven tensions and a global response to the dominance of the US dollar.

China, not only the world’s largest consumer of gold but also its biggest producer, has witnessed a surge in demand amid economic shifts. With manufacturing slowing and property markets facing uncertainty, Chinese consumers have turned to gold, driving a remarkable 10% increase in jewellery consumption and a staggering 30% rise in coin and gold bar purchases.

Yet, the surge in demand is not solely driven by domestic factors. Geopolitical motivations underpin China’s strategic shift towards gold. Amid efforts to diversify away from the US dollar, China’s central bank has steadily accumulated gold reserves over the past two years, viewing gold as a crucial component of its future holdings.

This trend extends beyond China, with central banks worldwide, particularly in emerging economies, bolstering their gold reserves as a hedge against geopolitical uncertainties. Gold, perceived as a safe asset independent of any single issuer or economy, offers refuge during times of turmoil in the global financial system.

India’s Reserve Bank, for instance, bolstered its gold holdings by purchasing 13 tonnes in January-February 2024, a move that added $3 billion to foreign reserves amidst gold appreciation. Similarly, Turkey, Kazakhstan, and Jordan have all increased their gold reserves, recognizing gold’s intrinsic value as the ultimate hedge.

Recent geopolitical tensions, including conflicts in Ukraine and Israel, alongside Iran’s unpredictability, have further enhanced gold’s appeal as a safe haven. The war in Ukraine, marked by sanctions and supply disruptions, has fueled fears of inflation and a global economic slowdown, prompting investors to seek refuge in gold.

As gold continues to glitter amidst the shadows of swords in the short term, its enduring allure as a hedge against uncertainty underscores its timeless appeal. In the words of Keynes, in the long run, amidst the ebbs and flows of geopolitics, gold remains a steadfast anchor.

The views expressed herein are personal and solely those of the author, a senior journalist with expertise in defense, and do not necessarily reflect the views of Firstpost.