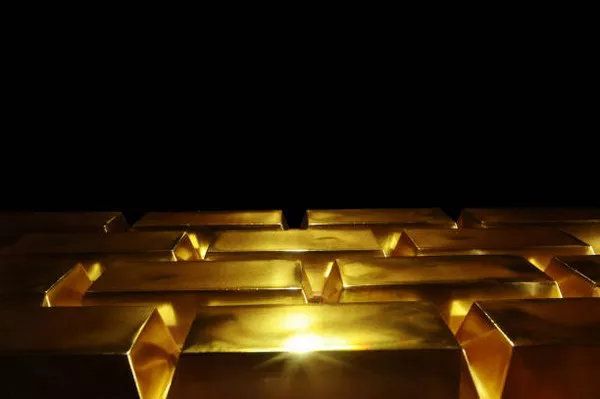

Despite a seemingly poor week for gold, down over 2% since Sunday night’s open, a closer examination of the weekly chart reveals that much of the decline stemmed from traders selling off their “weekend insurance” after the Middle East conflict failed to escalate beyond Israel’s retaliatory strikes on Friday.

When excluding this move, gold prices remained within a narrow $30 band after briefly dipping below $2,300 on Tuesday as markets absorbed moderately concerning economic data.

Analysts and institutional players perceive this week’s consolidation as a precursor to potential future gains. Marc Chandler, Managing Director at Bannockburn Global Forex, highlighted the positive aspects of this week’s price action, noting that gold found support near $2,300 and could test $2,370 in the days ahead. Chandler emphasized that the upcoming US jobs data would be crucial for gold’s trajectory.

Adrian Day, President of Adrian Day Asset Management, echoed this sentiment, pointing out increasing global buying interest in gold, particularly by central banks and Chinese consumers seeking safe-haven assets amidst economic uncertainties.

Adam Button, head of currency strategy at Forexlive.com, emphasized the importance of distinguishing between safe-haven demand and underlying fundamentals driving gold prices. Button noted that geopolitical tensions in the Middle East may have a limited impact on gold prices compared to broader economic factors, particularly those related to Chinese demand.

Looking ahead, the focus shifts to global retail demand outside of China as a potential catalyst for further price appreciation in gold.

Next week’s economic agenda, including the Federal Reserve’s monetary policy decision and the release of the nonfarm payrolls report, will likely influence market sentiment. Darin Newsom, Senior Market Analyst at Barchart.com, anticipates a possible pullback in gold prices based on technical indicators, while James Stanley, senior market strategist at Forex.com, expects dovish signals from the Fed to support gold prices.

Sean Lusk, co-director of commercial hedging at Walsh Trading, emphasized ongoing geopolitical tensions and inflationary pressures as key drivers for gold’s upward trajectory. Lusk suggested that the employment report, while important, may take a backseat to inflation indicators in shaping market sentiment.

Despite the recent volatility, sentiment among analysts remains largely optimistic for gold prices. The Kitco News Gold Survey revealed a consensus among experts favoring higher gold prices next week, reflecting ongoing bullish sentiment despite short-term fluctuations.

In conclusion, while gold faced challenges this week, market participants remain focused on the broader economic landscape and geopolitical developments as potential catalysts for future price movements. Gold closed the week at $2,337.40 per ounce, up 0.22% on the day but down 2.27% for the week, reflecting the underlying volatility and uncertainty in global markets.